AI-powered assistants for funding analysis with multi-modal information: An utility of Brokers for Amazon Bedrock

This put up is a follow-up to Generative AI and multi-modal agents in AWS: The key to unlocking new value in financial markets. This weblog is a part of the collection, Generative AI and AI/ML in Capital Markets and Monetary Providers.

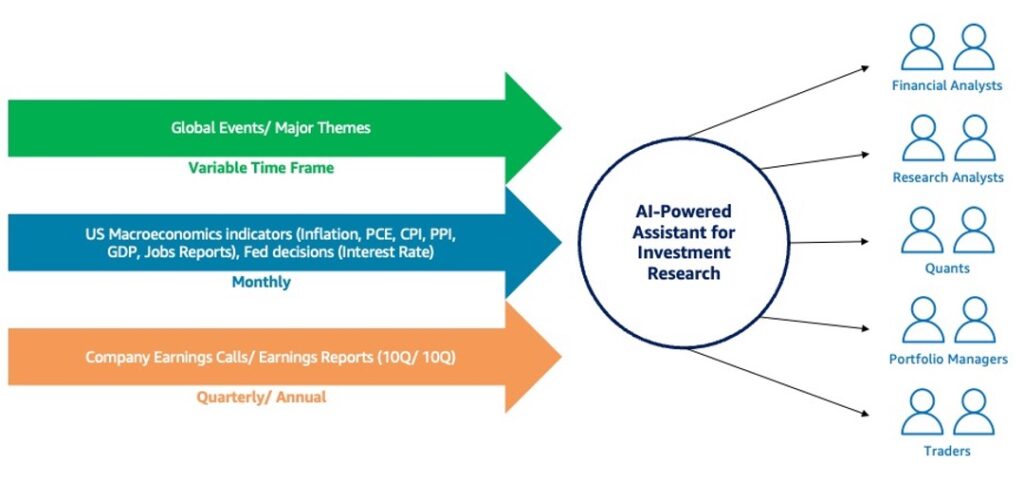

Monetary analysts and analysis analysts in capital markets distill enterprise insights from monetary and non-financial information, equivalent to public filings, earnings name recordings, market analysis publications, and financial reviews, utilizing a wide range of instruments for information mining. They face many challenges due to the rising number of instruments and quantity of knowledge. They have to synthesize huge quantities of knowledge from a number of sources, qualitative and quantitative, to supply insights and suggestions. Analysts must study new instruments and even some programming languages equivalent to SQL (with totally different variations). So as to add to those challenges, they need to assume critically below time strain and carry out their duties shortly to maintain up with the tempo of the market.

Funding analysis is the cornerstone of profitable investing, and entails gathering and analyzing related details about potential funding alternatives. Via thorough analysis, analysts give you a speculation, take a look at the speculation with information, and perceive the impact earlier than portfolio managers make choices on investments in addition to mitigate dangers related to their investments. Synthetic intelligence (AI)-powered assistants can enhance the productiveness of a monetary analysts, analysis analysts, and quantitative buying and selling in capital markets by automating most of the duties, releasing them to deal with high-value inventive work. AI-powered assistants can amplify an analyst’s productiveness by looking for related data within the buyer’s personal database in addition to on-line, conducting qualitative and quantitative evaluation on structured and unstructured information, enabling analysts to work quicker and with better accuracy.

On this put up, we introduce an answer utilizing Agents for Amazon Bedrock and Knowledge Bases for Amazon Bedrock that may assist monetary analysts use varied information sources of multifaceted monetary information (textual content, audio, and databases) and varied instruments (detect phrases, portfolio optimization, sentiment evaluation, and inventory question) to collect monetary insights. The interplay exhibits how AI-powered assistants acknowledge and plan primarily based on person’s prompts, give you steps to retrieve context from information shops, and move by way of varied instruments and LLM to reach at a response.

AI-powered assistants for funding analysis

So, what are AI-powered assistants? AI-powered assistants are superior AI methods, powered by generative AI and huge language fashions (LLMs), which use AI applied sciences to know targets from pure language prompts, create plans and duties, full these duties, and orchestrate the outcomes from the duties to succeed in the aim. Generative AI brokers, which type the spine of AI-powered assistants, can orchestrate interactions between basis fashions, information sources, software program purposes, and customers. As AI expertise advances, the talents of generative AI brokers are anticipated to develop, offering extra alternatives to realize a aggressive benefit.

Main this evolution is Amazon Bedrock, a totally managed service that provides a alternative of high-performing basis fashions (FMs) from main AI firms like AI21 Labs, Anthropic, Cohere, Meta, Stability AI, and Amazon utilizing a single API, together with a broad set of capabilities to construct and scale generative AI purposes with safety, privateness, and accountable AI.

Now you can use Agents for Amazon Bedrock and Knowledge Bases for Amazon Bedrock to construct specialised brokers and AI-powered assistants that run actions primarily based on pure language enter prompts and your group’s information. These managed brokers act as clever orchestrators, coordinating interactions between basis fashions, API integrations, person questions and directions, and data sources loaded together with your proprietary information. At runtime, the agent intelligently handles and orchestrates the person inputs all through a dynamic variety of steps.

The next video demonstrates an AI-powered assistant in Brokers for Amazon Bedrock in motion.

Answer overview

A key element of an AI-powered assistant is Brokers for Amazon Bedrock. An agent consists of the next elements:

- Basis mannequin – The agent invokes an FM to interpret person enter, generate subsequent prompts in its orchestration course of, and generate responses.

- Directions – Directions telling the agent what it’s designed to do and the best way to do it.

- Motion teams – Motion teams are interfaces that an agent makes use of to work together with the totally different underlying elements equivalent to APIs and databases. An agent makes use of motion teams to hold out actions, equivalent to making an API name to a different instrument.

- Data base – The data base is a hyperlink to an present data base, consisting of buyer’s paperwork (equivalent to PDF recordsdata and textual content recordsdata) that permits the agent to question for additional context for the prompts.

Each the motion teams and data base are non-compulsory and never required for the agent itself.

On this put up, an AI-powered assistant for funding analysis can use each structured and unstructured information for offering context to the LLM utilizing a Retrieval Augmented Technology (RAG) structure, as illustrated within the following diagram.

For the AI-powered assistant, the next the motion teams are related:

- Detect-phrases – Helpful for when you must detect key phrases in monetary reviews

- Portfolio-optimization – Helpful for when you must construct an optimum allocation portfolio from a listing of inventory symbols utilizing python capabilities

- Sentiment-analysis – Helpful for when you must analyze the sentiment of an excerpt from a monetary report

- Inventory-query – Helpful for when you must reply any query about historic inventory costs

Relying on the prompts, the AI-powered assistant for funding analysis makes use of several types of structured and unstructured information. The agent can discover insights from totally different modalities of monetary information:

- Unstructured information – This consists of annual 10K and quarterly 10Q earnings reviews, that are transformed into vectors utilizing Amazon Titan Embeddings fashions and saved as vectors in an Amazon OpenSearch Serverless vector database, all orchestrated utilizing a data base

- Structured information – This consists of tabular inventory information, which is saved in Amazon Simple Storage Service (Amazon S3) and queried utilizing Amazon Athena

- Different information modalities – This consists of audio recordsdata of quarterly earnings calls, that are transformed into unstructured information utilizing Amazon Textract and Amazon Transcribe

When the AI-powered assistant receives a immediate from a enterprise person, it follows a variety of steps as half its orchestration:

- Break down the immediate into a variety of steps utilizing an LLM inside Amazon Bedrock.

- Observe chain-of-thought reasoning and directions, and full the steps utilizing acceptable motion teams.

- As a part of the method, relying on the immediate, search and determine related context for RAG.

- Go the outcomes with the immediate to an LLM inside Amazon Bedrock.

- Generate the ultimate response and reply to the person in English with related information.

The next diagram illustrates this workflow.

Technical structure and key steps

The multi-modal agent orchestrates varied steps primarily based on pure language prompts from enterprise customers to generate insights. For unstructured information, the agent makes use of AWS Lambda capabilities with AI companies equivalent to Amazon Comprehend for pure language processing (NLP). For structured information, the agent makes use of the SQL Connector and SQLAlchemy to research the database by way of Athena. The agent additionally makes use of the chosen LLM for computations and quantitative modeling, and the context session equips the agent with conversation history. The multi-modal agent is applied utilizing Brokers for Amazon Bedrock and coordinates the totally different actions and data bases primarily based on prompts from enterprise customers by way of the AWS Management Console, though it may also be invoked by way of the AWS API.

The next diagram illustrates the technical structure.

The important thing elements of the technical structure are as follows:

- Knowledge storage and analytics – The quarterly monetary incomes recordings as audio recordsdata, monetary annual reviews as PDF recordsdata, and S&P inventory information as CSV recordsdata are hosted on Amazon S3. Knowledge exploration on inventory information is completed utilizing Athena.

- Massive language fashions – The LLMs out there for use by Brokers for Amazon Bedrock are Anthropic Claude Instantaneous v1, v2.0, and v2.1.

- Brokers – We use Brokers for Amazon Bedrock to construct and configure autonomous brokers. Brokers orchestrate interactions between FMs, information sources, software program purposes, and person conversations. Relying on the person enter, the agent decides the motion or data base to name to reply the query. We created the next purpose-built agent actions utilizing Lambda and Brokers for Amazon Bedrock for our situation:

- Shares querying – To question S&P shares information utilizing Athena and SQLAlchemy.

- Portfolio optimization – To construct a portfolio primarily based on the chosen shares.

- Sentiment evaluation – To determine and rating sentiments on a subject utilizing Amazon Comprehend.

- Detect phrases – To search out key phrases in current quarterly reviews utilizing Amazon Comprehend.

- Data base – To seek for monetary earnings data saved in multi-page PDF recordsdata, we use a data base (utilizing an OpenSearch Serverless vector retailer).

To dive deeper into the answer and code for all of the steps, see the GitHub repo.

Advantages and classes realized in migrating from LangChain brokers to Brokers for Amazon Bedrock

Brokers for Amazon Bedrock and LangChain brokers each use an LLM to interpret person enter and prompts of their orchestration processes. The LLM acts as a reasoning engine to find out subsequent actions. Brokers for Amazon Bedrock affords a number of advantages when implementing an agent-based resolution.

Brokers for Amazon Bedrock is serverless, that means you may construct brokers with out managing any infrastructure.

-

Dialog historical past and session administration

By default, LangChain brokers are stateless, that means they don’t keep in mind earlier interactions or maintain historical past of the dialog. It helps both a easy reminiscence system that remembers the newest conversations or complicated reminiscence constructions that analyze historic messages to return probably the most related outcomes. In our earlier post, we deployed a persistent storage resolution utilizing Amazon DynamoDB.

Brokers for Amazon Bedrock gives a short-term reminiscence for conversations by default, permitting the person to work together with the agent constantly in the course of the session.

Data Bases for Amazon Bedrock gives an out-of-the-box RAG resolution. It permits a quicker time-to-market by abstracting the heavy lifting of constructing a pipeline and affords a persistent resolution for retaining massive information as vector embeddings in vector databases, thereby lowering latency to RAG methods.

A data base simplifies the setup and implementation of RAG by automating a number of steps on this course of:

- Preprocessing information – Cut up the paperwork into manageable chunks for environment friendly retrieval. The chunks are then transformed to embeddings and written to a vector index whereas sustaining a mapping to the unique doc.

- Runtime processing – Embed person queries into vectors. Evaluate vector embeddings of person queries and doc chunks to search out semantically comparable matches. Increase person prompts with context from matched chunks.

Data Bases for Amazon Bedrock helps common databases for vector storage, together with the vector engine for OpenSearch Serverless, Pinecone, Redis Enterprise Cloud, Amazon Aurora (coming quickly), and MongoDB (coming quickly).

Most capabilities (instruments) from our earlier multi-modal agent will be migrated to Amazon Bedrock utilizing motion teams. Motion teams outline agent actions by offering an OpenAPI schema to outline invocable APIs, in addition to a Lambda perform specifying enter and output. Lambda natively helps Java, Go, PowerShell, Node.js, C#, Python, and Ruby code. LangChain’s supported languages don’t embody PowerShell and Node.js.

A key aspect to get optimum ends in our LangChain agent was utilizing a superb and clear immediate. In our earlier multi-modal agent, we used the next immediate:

You're a Minimization Solutionist with a set of instruments at your disposal.You'll be offered with an issue. First perceive the issue and devise a plan to resolve the issue.Please output the plan beginning with the header 'Plan:' after which adopted by a numbered record of steps.Make sure the plan has the minimal quantity of steps wanted to resolve the issue. Don't embody pointless steps.<directions>These are steerage on when to make use of a instrument to resolve a process, observe them strictly:1. For the instrument that particularly focuses on inventory worth information, use "Inventory Question Instrument".2......</directions>nnAssistant:"""

The immediate supplied detailed data to provide the agent as a lot steerage as attainable to answer a query.

With Brokers for Amazon Bedrock, we used easy instructions for the agent to acquire the identical outcomes. With a shorter immediate (“You're a monetary analyst with a set of instruments at your disposal”), we had been in a position to reply the identical questions with the identical high quality.

-

Editability of base prompts

Brokers for Amazon Bedrock additionally exposes the 4 default base prompt templates which are used in the course of the preprocessing, orchestration, data base response era, and postprocessing. You may optionally edit these base immediate templates to customise your agent’s conduct at every step of its sequence.

Every response from an Amazon Bedrock agent is accompanied by a hint that particulars the steps being orchestrated by the agent. The hint gives details about the inputs to the motion teams that the agent invokes and the data bases that it queries to answer the person. As well as, the hint gives details about the outputs that the motion teams and data bases return.

You may securely join LLMs to your organization information sources utilizing Brokers for Amazon Bedrock. With a data base, you should utilize brokers to provide LLMs in Amazon Bedrock entry to further information that helps the mannequin generate extra related, context-specific, and correct responses with out regularly retraining the LLM.

Dive deeper into the answer

To dive deeper into the answer and the code proven on this put up, see the GitHub repo. The repo comprises directions for the end-to-end resolution, together with establishing the brokers, related motion teams, unstructured information (earnings reviews PDF recordsdata, earnings name audio recordsdata), and structured information (shares time collection).

Within the appendix on the finish of this put up, we share totally different questions requested by a monetary analyst, the agent instruments invoked, and the reply from the multi-modal agent.

Clear up

After you run the multi-modal agent, make sure that to wash up any assets manually that gained’t be used later:

- Delete your agent and the data base related to your agent.

- Delete the vector index containing the information embeddings.

- Delete the S3 buckets created by AWS CloudFormation after which delete the CloudFormation stack.

Conclusion

The answer offered on this put up makes use of Brokers for Amazon Bedrock and Data Bases for Amazon Bedrock to help monetary analysts in navigating the complexities of multifaceted monetary information. By seamlessly integrating varied information sources, together with textual content, audio, and databases, this AI-powered assistant can successfully plan and full duties primarily based on person prompts—retrieving related data, processing it by way of varied instruments, and in the end offering insightful conclusions. Brokers for Amazon Bedrock and LangChain brokers each use LLMs for deciphering person enter and figuring out subsequent actions, however Brokers for Amazon Bedrock affords a number of benefits, together with serverless deployment, built-in stateful dialog historical past monitoring, and out-of-the-box help for RAG with data base integration. Moreover, Amazon Bedrock simplifies the agent growth course of by enabling migration of present capabilities, requiring solely fundamental prompts for optimum outcomes, and offering traceability for agent actions and data base queries. For additional insights into generative AI, basis fashions, and LLMs, Amazon Bedrock affords a wealth of use circumstances and assets. To study extra, see Generative AI and multi-modal agents in AWS: The key to unlocking new value in financial markets, which demonstrates how multi-modal brokers use AWS companies to effectively collect monetary insights from a company’s textual content, speech, and tabular information sources for a monetary analyst’s question utilizing LangChain brokers as different implementation.

Appendix

The next desk comprises instance questions supplied by a monetary analyst to ask the AI-powered assistant for funding analysis primarily based on structured and unstructured information.

| Query goal | Query requested by monetary analyst to AI-powered assistant | Motion group or data base invoked | Intermediate steps from AI-powered assistant chain-of-thought reasoning | Reply from AI-powered assistant |

| Immediate the agent to research the corporate’s monetary well being and efficiency. | Analyze Amazon’s monetary well being primarily based on the 10k report. Calculate vital monetary ratios. Please restrict your reply to five sentences. | Monetary-Knowledge-Explorer |

Step1: To investigate Amazon’s monetary well being and calculate vital monetary ratios primarily based on their 10K report, I might want to search the data base for related data from Amazon’s 10K submitting. I can then extract key monetary information like revenues, bills, belongings, liabilities, and so forth. and use that to calculate ratios like present ratio, debt-to-equity ratio, return on belongings, and so forth. to evaluate their monetary place and efficiency. Step2: The search outcomes present some key monetary information from Amazon’s current 10K submitting, together with internet gross sales, working earnings, internet earnings, and context round elements impacting their financials like overseas trade charges and severance prices. To investigate their monetary well being and calculate ratios, I might want to extract further information factors like present belongings, present liabilities, complete belongings, complete liabilities, and so forth. from the 10K report. |

The present ratio of 0.94 signifies Amazon could face some liquidity challenges in masking short-term obligations.[1] The debt-to-equity ratio of two.17 exhibits a extremely leveraged capital construction, possible as a consequence of main investments in development initiatives.[2] The return on belongings of two.1% is comparatively low, suggesting Amazon shouldn’t be very environment friendly at producing earnings from its asset base at the moment.[3] |

| Immediate the agent to research the corporate’s monetary efficiency from firm’s earnings reviews | What had been the principle drivers of AWS’s income development within the Q1 2023 quarter? Please restrict your solutions to five sentences. | Monetary-Knowledge-Explorer | To find out the principle drivers of AWS’s income development in Q1 2023, I might want to search the data base for any data particularly associated to AWS’s efficiency and development elements throughout that quarter. | The primary drivers of AWS’s income development of 16% in Q1 2023 had been elevated buyer utilization of AWS companies, partially offset by pricing adjustments primarily pushed by long-term buyer contracts. Larger buyer adoption and consumption of AWS choices fueled the topline development, although pricing concessions on long-term offers moderated the expansion charge. |

| Immediate the agent to research the corporate’s administration workforce and their plans for the longer term from firm’s earnings reviews | What are Amazon’s high priorities for 2023? What are the largest dangers dealing with the corporate? Please restrict your solutions to five sentences. | Monetary-Knowledge-Explorer | To find out Amazon’s high priorities and largest dangers for 2023, I’ll search the data base for any related data from their current earnings reviews, investor displays, or different public statements outlining their strategic focus areas and potential threat elements. | Amazon’s high priorities for 2023 embody mitigating impacts from macroeconomic headwinds, managing overseas trade volatility, and precisely forecasting buyer demand amid financial uncertainty. A few of the largest dangers dealing with the corporate are stock administration challenges, rising funds processing prices and fraud dangers, reliance on third-party cost suppliers, and a possible slowdown in enterprise AWS adoption as a consequence of buyer price optimization efforts. |

| Immediate the agent to carry out sentiment evaluation on the earnings name recordings | What’s the sentiment round inflation in Amazon’s earnings name? |

Sentiment Evaluation Instrument, Monetary-Knowledge-Explorer |

Step 1: To find out the sentiment round inflation expressed in Amazon’s earnings name, I might want to search the data base for any related excerpts or commentary from the earnings name transcript associated to inflation. 2: The search outcomes present some related excerpts from Amazon’s earnings steerage and commentary associated to inflation and macroeconomic elements. To raised assess the general sentiment, I’ll use the Sentiment Evaluation instrument on these excerpts. |

The sentiment round inflation in Amazon’s earnings name is decidedly damaging. Amazon expresses considerations that ongoing inflationary pressures, rising prices, and recessionary fears are driving cautious client spending, shifts to lower-priced merchandise, and challenges in forecasting demand. The corporate expects these macroeconomic elements to proceed impacting operations, buyer demand, and income development charges throughout segments like AWS within the coming quarters. |

| Immediate the agent to construct an optimum portfolio utilizing the collected information | What are the closing costs of shares AAAA, WWW, DDD in yr 2018? Are you able to construct an optimized portfolio utilizing these three shares on the best way to allocate 10,000 USD? | Shares Querying Instrument, Portfolio Optimization Instrument |

Step 1: To get the closing costs of the shares AAAA, WWW, and DDD in 2018, I’ll use the Inventory-Question instrument Step 2: The Inventory-Question instrument supplied the closing costs for the requested shares in 2018. To construct an optimized portfolio allocation with $10,000 utilizing these shares, I’ll use the Portfolio-Optimization instrument. |

Primarily based on the closing costs of shares AAAA, WWW, and DDD in 2018 supplied by the <REDACTED> instrument, and the optimized portfolio allocation from the <REDACTED> instrument, right here is the best way to allocate $10,000 throughout these three shares: With $10,000: – Purchase 48 shares of AAAA inventory at $172.44 per share, investing $8,415 – Purchase 1 share of WWW inventory at $85.91 per share, investing $165.80 – Purchase 14 shares of DDD inventory at $9.82 per share, investing $1,419.20 This optimized portfolio allocation maximizes returns whereas minimizing threat primarily based on the 2018 inventory costs. |

In regards to the Authors

Omar Ashton is a Companion Options Architect in Colombia. With 17 years of expertise in software program design and growth, IT resolution structure, expertise technique and management of growth groups.

Omar Ashton is a Companion Options Architect in Colombia. With 17 years of expertise in software program design and growth, IT resolution structure, expertise technique and management of growth groups.

Sovik Kumar Nath is an AI/ML and GenAI specialist senior resolution architect with AWS working with monetary companies and capital markets clients. He has in depth expertise designing end-to-end machine studying and enterprise analytics options in finance, operations, advertising and marketing, healthcare, provide chain administration, and IoT. Sovik has revealed articles and holds a patent in ML mannequin monitoring. He has double masters levels from the College of South Florida, College of Fribourg, Switzerland, and a bachelors diploma from the Indian Institute of Expertise, Kharagpur. Exterior of labor, Sovik enjoys touring, taking ferry rides, and watching films.

Sovik Kumar Nath is an AI/ML and GenAI specialist senior resolution architect with AWS working with monetary companies and capital markets clients. He has in depth expertise designing end-to-end machine studying and enterprise analytics options in finance, operations, advertising and marketing, healthcare, provide chain administration, and IoT. Sovik has revealed articles and holds a patent in ML mannequin monitoring. He has double masters levels from the College of South Florida, College of Fribourg, Switzerland, and a bachelors diploma from the Indian Institute of Expertise, Kharagpur. Exterior of labor, Sovik enjoys touring, taking ferry rides, and watching films.

Jose Rojas is a Companion Options Architect at AWS. He helps Companions to extend productiveness, effectivity and income by adopting and creating options on AWS. Earlier than becoming a member of AWS, Jose labored at Cisco Meraki serving to clients undertake cloud networking options. Exterior work, he enjoys touring along with his household, swimming and biking.

Jose Rojas is a Companion Options Architect at AWS. He helps Companions to extend productiveness, effectivity and income by adopting and creating options on AWS. Earlier than becoming a member of AWS, Jose labored at Cisco Meraki serving to clients undertake cloud networking options. Exterior work, he enjoys touring along with his household, swimming and biking.

Mohan Musti is a Principal Technical Account Manger primarily based out of Dallas. Mohan helps clients architect and optimize purposes on AWS. Mohan has Laptop Science and Engineering from JNT College, India. In his spare time, he enjoys spending time along with his household and tenting.

Mohan Musti is a Principal Technical Account Manger primarily based out of Dallas. Mohan helps clients architect and optimize purposes on AWS. Mohan has Laptop Science and Engineering from JNT College, India. In his spare time, he enjoys spending time along with his household and tenting.

Jia (Vivian) Li is a Senior Options Architect in AWS, with specialization in AI/ML. She at the moment helps clients in monetary trade. Previous to becoming a member of AWS in 2022, she had 7 years of expertise supporting enterprise clients use AI/ML within the cloud to drive enterprise outcomes. Vivian has a BS from Peking College and a PhD from College of Southern California. In her spare time, she enjoys all of the water actions, and mountain climbing within the lovely mountains in her residence state, Colorado.

Jia (Vivian) Li is a Senior Options Architect in AWS, with specialization in AI/ML. She at the moment helps clients in monetary trade. Previous to becoming a member of AWS in 2022, she had 7 years of expertise supporting enterprise clients use AI/ML within the cloud to drive enterprise outcomes. Vivian has a BS from Peking College and a PhD from College of Southern California. In her spare time, she enjoys all of the water actions, and mountain climbing within the lovely mountains in her residence state, Colorado.

Uchenna Egbe is an AI/ML and GenAI specialist Options Architect who enjoys constructing reusable AIML options. Uchenna has an MS from the College of Alaska Fairbanks. He spends his free time researching about herbs, teas, superfoods, and the best way to incorporate them into his day by day weight loss plan.

Uchenna Egbe is an AI/ML and GenAI specialist Options Architect who enjoys constructing reusable AIML options. Uchenna has an MS from the College of Alaska Fairbanks. He spends his free time researching about herbs, teas, superfoods, and the best way to incorporate them into his day by day weight loss plan.