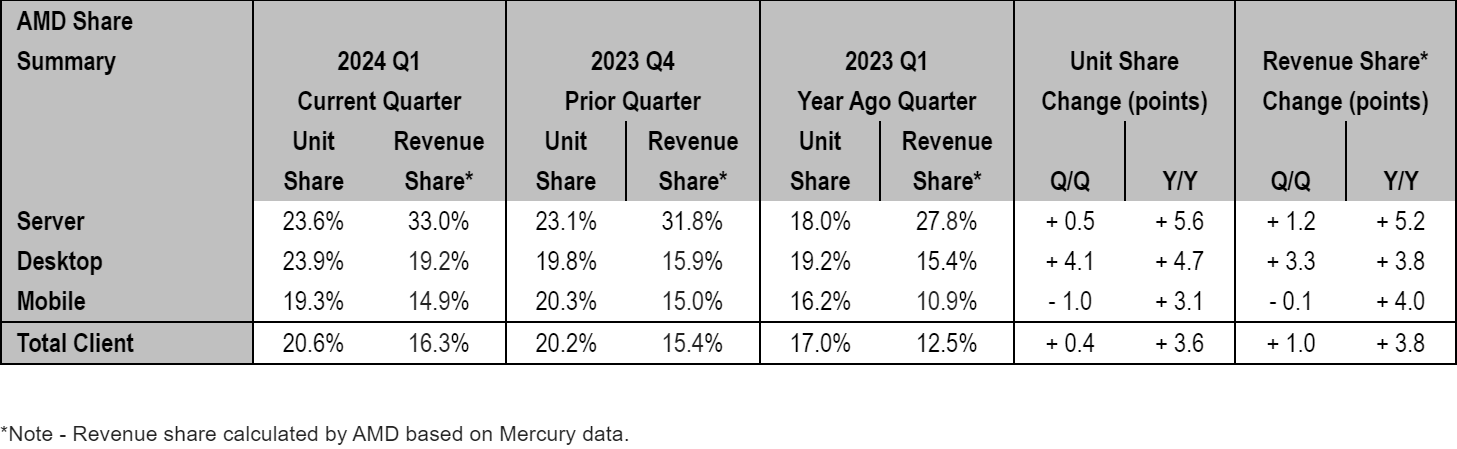

AMD Hits Document Excessive Share in x86 Desktops and Servers in Q1 2024

Popping out of the darkish instances that preceded the launch of AMD’s Zen CPU structure in 2017, to say that AMD has turned issues round on the again of Zen could be an understatement. Ever since AMD launched its first Zen-based Ryzen and EPYC processors for consumer and server computer systems, it has been constantly gaining x86 market share, rising from a bit participant to a good rival to Intel (and all at Intel’s expense).

The primary quarter of this 12 months was no exception, in line with Mercury Research, as the corporate achieved document excessive unit shares on x86 desktop and x86 server CPU markets on account of success of its Ryzen 8000-series consumer merchandise and 4th Technology EPYC processors.

“Mercury famous of their first quarter report that AMD gained important server and consumer income share pushed by rising demand for 4th Gen EPYC and Ryzen 8000 sequence processors,” a press release by AMD reads.

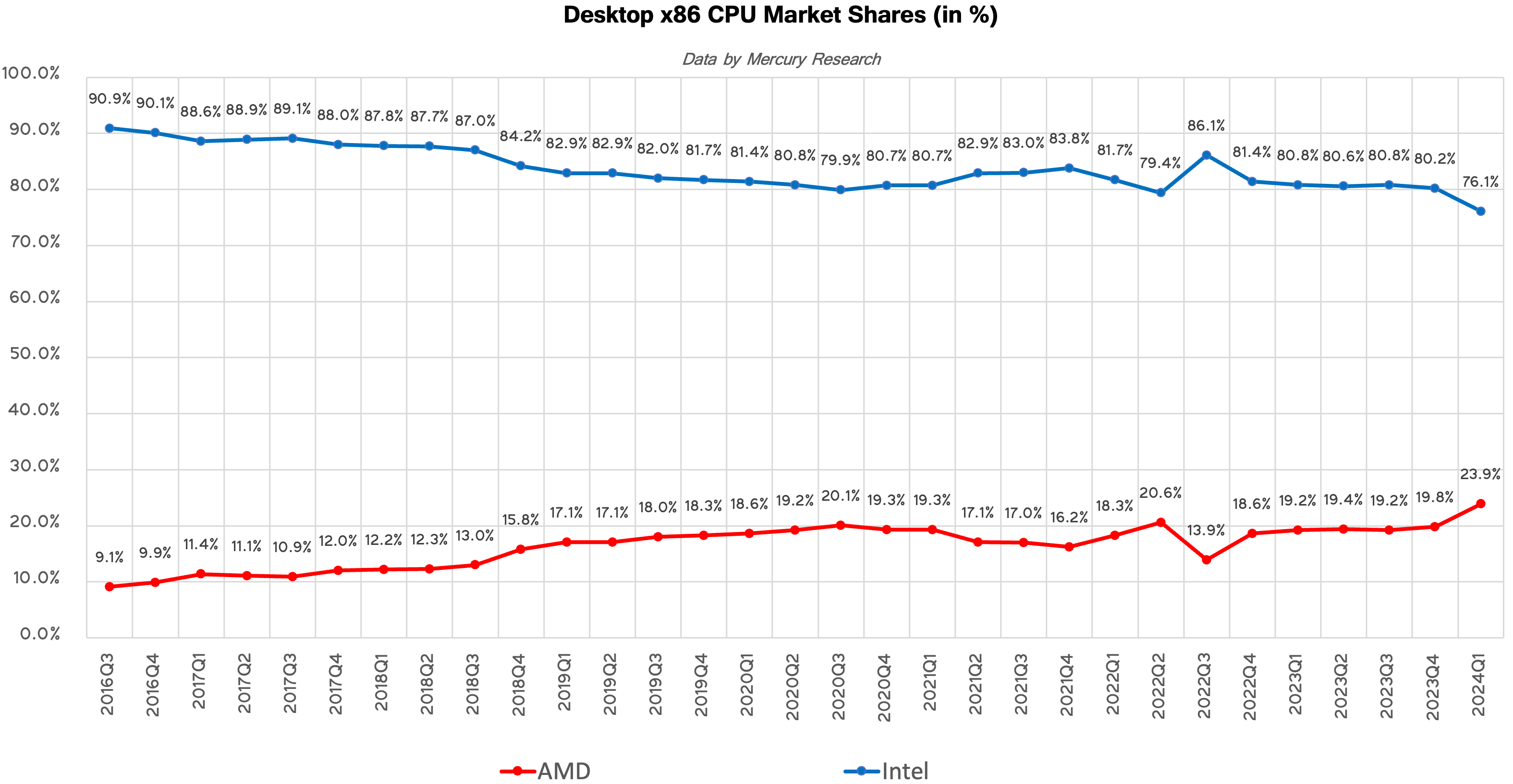

Desktop PCs: AMD Achieves Highest Share in Extra Than a Decade

Desktops, notably DIY desktops, have at all times been AMD’s strongest market. After the corporate launched its Ryzen processors in 2017, it doubled its presence in desktops in simply three years. However within the latest years the corporate needed to prioritize manufacturing of costlier CPUs for datacenters, which result in some erosion of its desktop and cellular market shares.

As the corporate secured extra capability at TSMC, it began to regularly enhance manufacturing of desktop processors. In This fall final 12 months it launched its Zen 4-based Ryzen 8000/Ryzen 8000 Professional processors for mainstream desktops, which seemed to be fairly in style with PC makers.

Because of this and different elements, AMD elevated unit gross sales of its desktop CPUs by 4.7% year-over-year in Q1 2024 and its market share achieved 23.9%, which is the very best desktop CPU market share the corporate commanded in over a decade. Curiously, AMD doesn’t attribute its success on the desktop entrance to any explicit product or product household, which suggests that there are a number of elements at play.

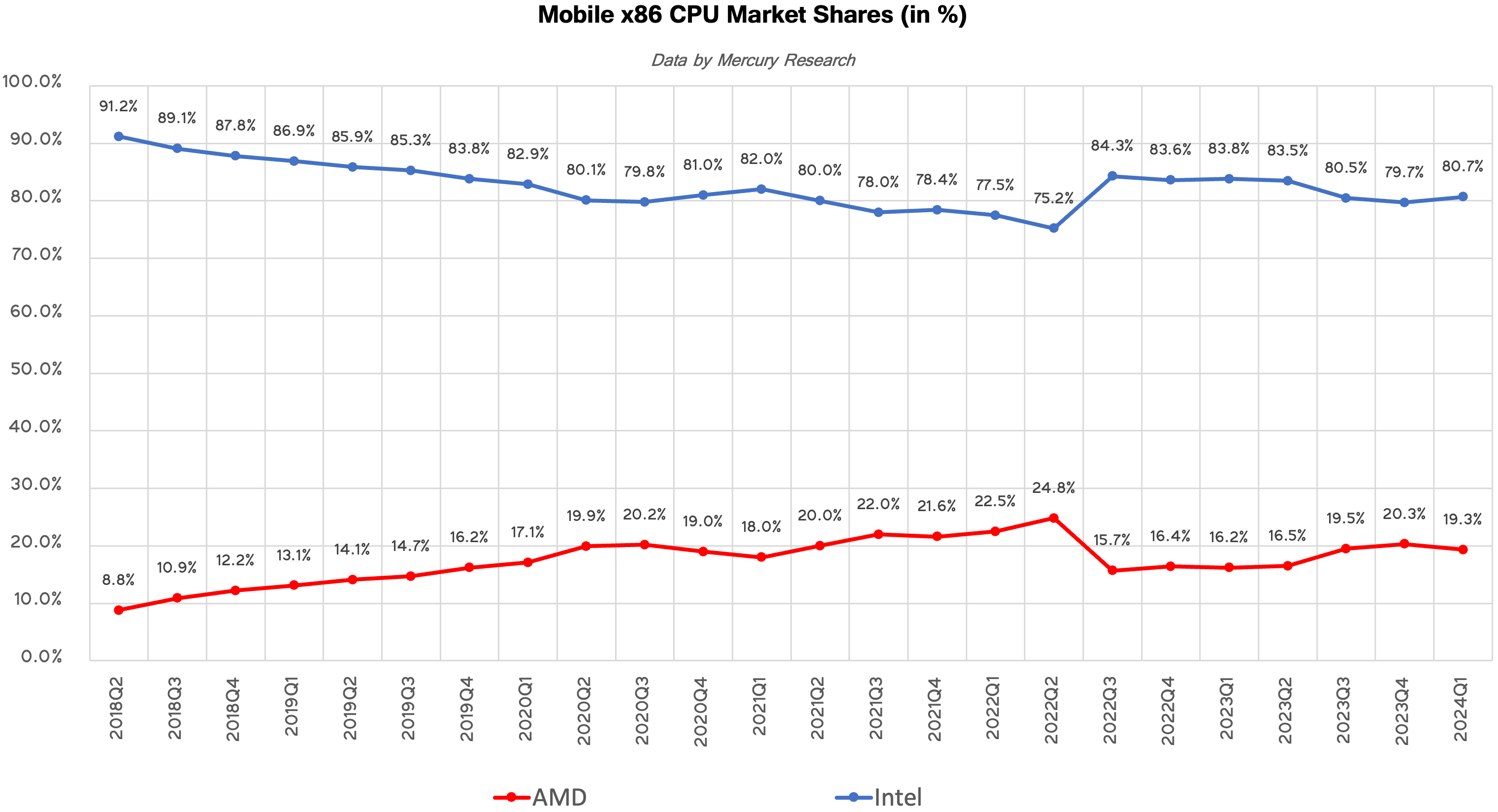

Cellular PCs: A Slight Drop for AMD amid Intel’s Meteor Lake Ramp

AMD has been regularly regaining its share inside laptops for about 1.5 years now and gross sales of its Zen 4-based Ryzen 7040-series processors had been fairly robust in Q3 2023 and This fall 2023, when the corporate’s unit share elevated to 19.5% and 20.3%, respectively, as AMD-based pocket book platforms ramped up. Against this, Intel’s Core Extremely ‘Meteor Lake’ powered machines solely started to hit retail cabinets in This fall’23, which affected gross sales of its processors for laptops.

Within the first quarter AMD’s unit share in the marketplace of CPUs for notebooks decreased to 19.3%, down 1% sequentially. In the meantime, the corporate nonetheless demonstrated important year-over-year unit share enhance of three.1% and income share enhance of 4%, which alerts rising common promoting worth of AMD’s newest Ryzen processors for cellular PCs.

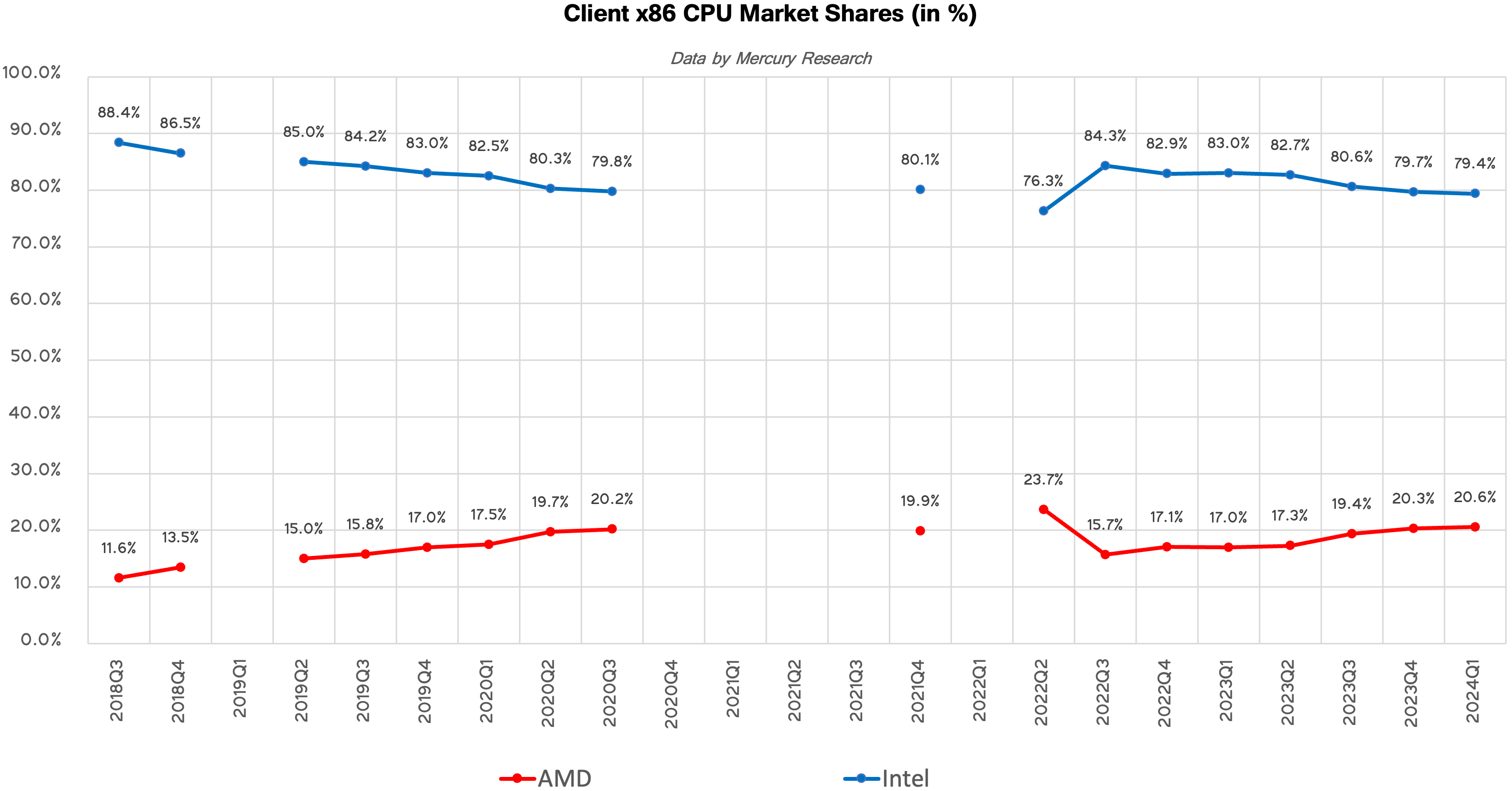

Shopper PCs: Slight Achieve for AMD, Small Loss for Intel

Total, Intel remained the dominant power in consumer PC gross sales within the first quarter of 2024, with a 79.4% market share, leaving 20.6% for AMD. This isn’t notably stunning given how robust and various Intel’s consumer merchandise lineup is. Even with continued success, it would take AMD years to develop gross sales by sufficient to utterly flip the market.

However AMD truly gained a 0.3% unit share sequentially and a 3.6% unit share year-over 12 months. Notably, nonetheless, AMD’s income share of consumer PC market is considerably decrease than its unit share (16.3% vs 20.6%), so the corporate continues to be considerably pigeonholed into promoting extra price range and fewer premium processors general. However the firm nonetheless made a robust 3.8% achieve for the reason that first quarter 2023, when its income share was round 12.5% amid unit share of 17%.

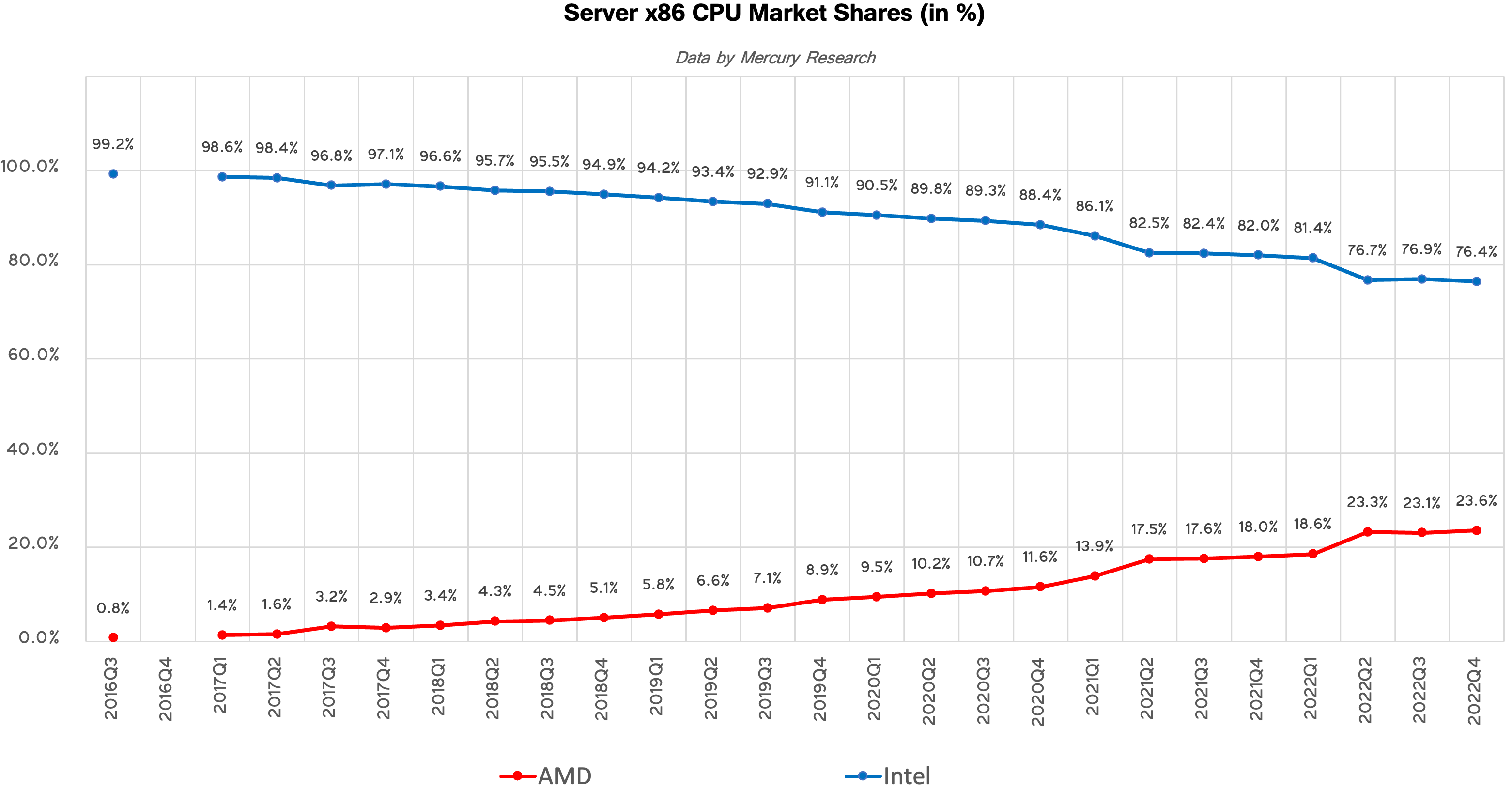

Servers: AMD Grabs One other Piece of the Market

AMD’s EPYC datacenter processors are undeniably the crown jewel of the corporate’s CPU product lineup. Whereas AMD’s market share in desktops and laptops fluctuated within the latest years, the corporate has been steadily gaining presence in servers each by way of models and by way of income within the extremely profitable (and worthwhile) server market.

In Q1 2024, AMD’s unit share in the marketplace of CPUs for servers elevated to 23.6%, a 0.5% achieve sequentially and a large 5% achieve year-over-year pushed by the ramp of platforms based mostly on AMD’s 4th Technology EPYC processors. With a 76.4% unit market share, Intel continues to dominate in servers, however it’s evident that AMD is getting stronger.

AMD’s income share of the x86 server market reached 33%, up 5.2% year-over-year and 1.2% from the earlier quarter. This alerts that the corporate is gaining traction in costly machines with superior CPUs. Retaining in thoughts that for now Intel doesn’t have direct rivals for AMD’s 96-core and 128-core processors, it’s no surprise that AMD has finished so effectively rising their share of the server market.

“As we famous throughout our first quarter earnings name, server CPU gross sales elevated YoY pushed by progress in enterprise adoption and expanded cloud deployments,” AMD mentioned in a press release.