3nm Income Share Jumps to fifteen%, 5nm Overtakes 7nm For 2023

Taiwan Semiconductor Manufacturing Co. launched its This autumn’2023 and full 12 months 2023 monetary outcomes this week. And together with a have a look at the monetary state of the agency because it enters 2024, the corporate’s earnings data additionally presents a contemporary have a look at the utilization of their numerous fab nodes. Of specific curiosity, with TSMC ramping up manufacturing of chips on its N3 (3 nm-class) course of know-how, N3 (aka N3B) has already reached the purpose the place it accounts for 15% of TSMC’s income in This autumn 2023. It is a very quick – albeit not document quick – income ramp.

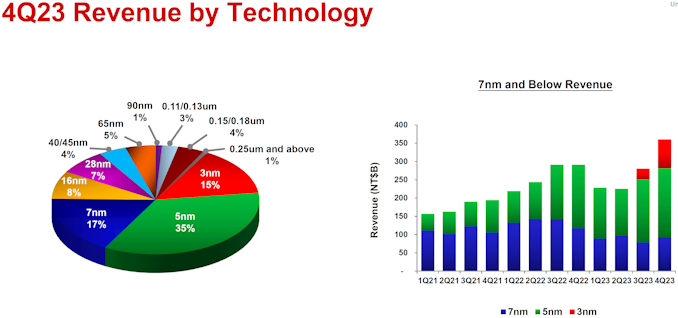

Within the fourth quarter of 2023, gross sales of wafers processed utilizing N3 accounted for 15% of TSMC’s complete wafer income, whereas income of N5 and N7 accounted for 39% and 17% respectively. By way of {dollars}, N3 income for TSMC was $2.943 billion, N5 gross sales totaled $6.867 billion, and N7 income reached $3.3354 billion. Usually, superior applied sciences (N7, N5, N3) commanded 67% of TSMC’s income, whereas the bigger grouping of FinFET-based course of applied sciences accounted for 75% of the corporate’s complete wafer income.

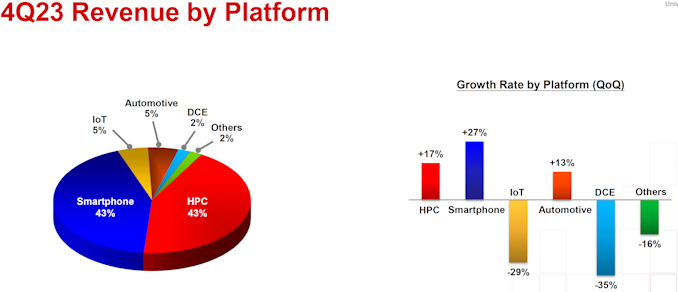

It’s noteworthy that income share contributions made by system-on-chips (SoCs) for smartphones and high-performance computing (a imprecise time period that TSMC makes use of to explain the whole lot from sport consoles to notebooks and from workstations to datacenter-grade processors) have been equal in This autumn 2023: 43% every. Automotive chips accounted for five%, and Web-of-Issues chips contributed one other 5%.

“Our fourth quarter enterprise was supported by the continued sturdy ramp of our industry-leading 3-nanometer know-how,” stated Wendell Huang, VP and Chief Monetary Officer of TSMC. “Shifting into first quarter 2024, we count on our enterprise to be impacted by smartphone seasonality, partially offset by continued HPC-related demand.”

To place TSMC’s N3 income share ramp into context, we have to examine it to the ramp of the foundry’s previous-generation all-new node: N5 (5 nm-class), which entered high-volume manufacturing in mid-2020. TSMC started to acknowledge its N5 income in Q3 2020 and the manufacturing node accounted for 8% of the corporate’s gross sales again then, which totaled $0.97 billion. Within the second quarter of its availability (Q4 2020), N5 accounted for 20% of TSMC’s income, or $2.536 billion.

There’s a main catch about TSMC’s N5 ramp in 2020 that muddles comparisons a bit, nevertheless. The world’s largest contract maker of chips offered boatload of N5-based system-on-chips to Huawei on the time (delivery them bodily earlier than the U.S. sanctions towards the corporate turned efficient in September, 2020) in addition to Apple. In contrast, it’s extensively believed that Apple is the only consumer to make use of TSMC’s N3B know-how on account of prices. Which implies that, even with the short ramp, TSMC has fewer prospects within the early days of N3 than they did in N5, contributing to the slower ramp for N3.

As for your entire 12 months, N3 wafer income account for six% of TSMC’s complete wafer income in 2023. In the meantime, N5 income has lastly overtaken N7 income in FY2023, after being edged out by N7 in FY2022. For 2023, N5 wafers accounted for 33% of TSMC’s income, and N7 wafers have been chargeable for 19% of the corporate’s income.

TSMC’s fourth quarter income totaled $19.62 billion, which represents a 1.5% year-over-year lower, or a quarterly improve of 13.6% over Q3 2023. In the meantime, the corporate shipped 2.957 million 300-mm equal wafers in This autumn 2023, up 1.9% sequentially. The corporate’s gross margin for the quarter was 53.0%, working margin was 41.6%, and internet revenue margin was 38.2%.

TSMC expects income in Q1 2024 to be between $18.0 billion and $18.8 billion, whereas gross margin is projected to be between 52% and 54%.