Demand Planning Analytics | In the direction of Information Science

On this part, we’ll focus on descriptive analytics that use forecasts and historic gross sales (actuals) within the calculations. Let’s notice that every one forecasts and actuals are for volumes offered on the granularity chosen. The chosen granularities (by way of product and buyer hierarchies, historic time durations, forecast varieties and so on.) within the visualizations beneath are merely examples and could be up to date to match a enterprise setup. The blue bins on the prime of every visualization are dropdowns the place the person can choose a number of gadgets (aside from Show Entity, the place we are able to choose just one entity). Show Entity is the extent at which the evaluation is visualized. Time interval denotes the newest previous interval (in months within the examples proven on this part) over which the evaluation is finished.

I. Scale and Variability of Demand

In Determine 2, we show precise gross sales on the SKU degree over the previous 12 months. That is displayed within the type of a boxplot highlighting the median, twenty fifth percentile, seventy fifth percentile, minimal and most of gross sales over the historic time interval.

Perception(s): The boxplots as proven in Determine 2 present a way of the size of demand (denoted by the median) over a historic time interval and the variability within the demand as expressed utilizing the interquartile vary (IQR). We could select to kind by the median or IQR to determine the most important quantity or largest variability gadgets, respectively.

Motion(s): Sometimes, we focus our forecasting efforts on excessive quantity and excessive variability gadgets, whereas utilizing a statistical forecast for low quantity or low variability gadgets.

II. Historic Gross sales Pareto

In Determine 3, we plot the actuals lifted by every buyer over the previous 6 months.

Perception(s): The chart in Determine 3 exhibits clients listed side-by-side in descending order of quantity lifted over 6 months. This view additionally allows us to calculate cumulative gross sales over this previous interval for a set of consumers.

Motion(s): Oftentimes, a small share of consumers are answerable for a majority of the demand (80–20 rule). It will be prudent to give attention to forecasting this stuff for the next return on time funding.

III. Constant Poor Performers

In Determine 4A and Determine 4B, we have a look at the uncooked and absolute deviation of the forecast from actuals, respectively, on the SKU degree summed over the previous 6 months.

Perception(s): The optimistic deviations in Determine 4A present areas the place we constantly over-forecast and the unfavourable deviations spotlight gadgets the place there may be constant under-forecasting. The second chart (Determine 4B) exhibits the place we get the forecast timing fallacious for the merchandise (intermittently over- and under-forecasted).

Motion(s): Ideally, we’d decrease the forecast for gadgets with a constant optimistic bias and improve the forecast for ones which have been persistently under-forecasted except the enterprise situations have modified. For those, the place we aren’t capable of seize the timing proper, we could need to collaborate with the shoppers to grasp the basis causes and seize the timing higher.

IV. Phase Objects based mostly on Forecast Accuracy

In Determine 5, we show the deviation between the gross sales forecast error and the statistical forecast error on the SKU-customer mixture aggregated over the previous 6 months.

Perception(s): The optimistic bias in Determine 5 exhibits the place the gross sales forecast had larger cumulative error over 6 months than the corresponding statistical forecast. The unfavourable deviations present the place the gross sales changes are making the forecast higher than the statistical forecast (i.e. the cumulative gross sales forecast error is decrease than the cumulative statistical forecast error over the chosen time interval).

Motion(s): To enhance the metrics, we’d use the statistical forecast for the gadgets with the optimistic deviations and the gross sales forecast for the entities with the unfavourable deviations. That is once more assuming enterprise situations stay secure.

V. Outliers based mostly on Current Gross sales

In Determine 6, we examine the deviation of the gross sales forecast for the following month from the common of the previous 3 months.

Perception(s): The optimistic errors in Determine 6 present the place we’re over-forecasting in comparison with current gross sales whereas the unfavourable deviations present the place we anticipate gross sales to be a lot decrease than current historical past.

Motion(s): We might need to intently evaluate the outliers, and confirm if the forecast is out of line, or if there was an anomaly in current gross sales, and modify the forecast if wanted.

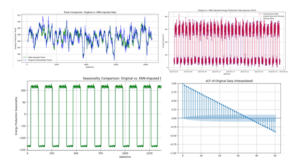

VI. Outliers based mostly on Progress and Seasonality

For these visuals, we usually select product household or larger degree since a lower-level attribute (e.g., SKU) could result in noise in development charges. For a similar motive, we have a tendency to take a look at outliers at a quarterly foundation as an alternative of month-to-month. In Determine 7A, we have a look at product households with gross sales forecast deviation from anticipated Q2 gross sales. The anticipated gross sales in Q2 are merely a product of the final accessible Q2 gross sales and the common development price for Q2 gross sales throughout a number of years. In Determine 7B, we deep dive into development charges (%) for a number of quarters trying year-over-year for the previous 3 years.

Perception(s): The optimistic errors in Determine 7A present the place we’re over-forecasting in comparison with anticipated gross sales accounting for common YoY development and seasonality, whereas the unfavourable deviations present the place we anticipate gross sales to be decrease than anticipated seasonality adjusted YoY development. Deep diving right into a product household (e.g., PF21) in Determine 7B, we discover that Q2 estimated development price for subsequent 12 months is far decrease than the common Q2 development price of the previous 3 years and warrants additional scrutiny.

Motion(s): The most important deviations (optimistic and unfavourable) have to be reviewed to grasp why the forecasts usually are not consistent with anticipated development and seasonality and adjusted accordingly.

VII. Value-Quantity Outliers

In Determine 8, we plot the normalized worth towards the amount for product household PF23. Whereas the value is normalized utilizing the value of related feed ‘Feed3’, the amount shouldn’t be normalized as we could not have knowledge on general trade demand for this or a comparable product household. For historic durations, historic costs and volumes are used to generate the scatter plot, whereas the forecasted costs and volumes are used to generate the forward-looking normalized worth and quantity forecast.

Perception(s): The scatter plot exhibits how the value (normalized) and quantity (normalized) are correlated at totally different granularities. Whereas this approximates how quantity strikes with worth modifications (notice that the normalizing entities themselves are approximations), the chart can assist determine forecast outliers (e.g., too excessive a forecasted (normalized) quantity for a given forecasted (normalized) worth, when evaluating towards (normalized) historic worth vs quantity tendencies).

Motion(s): We discover forecast outliers on the worth vs quantity chart for the forecasting horizon and evaluate historic enterprise context and present market demand and provide situations to evaluate if the outlier values are justified. If not, the volumes or costs are adjusted to deliver the forecasts consistent with historic tendencies.

VIII. Entities with Constant Forecast Degradation or Enchancment over Time

In Determine 9A, we analyze the efficiency of the Lag2Final Forecast (forecast finalized 2 months previous to month with the actuals being analyzed) on the SKU degree over the previous 6 months. Going additional, we additionally examine the product household gadgets which have the smallest Lag2Final Forecast absolute error over 6 months as proven in Determine 9B. To know the tendencies for every of this stuff, we plot the totally different lag forecasts vs actuals in Determine 9C.

Perception(s): From Determine 9A, we are able to determine the entities which are constantly over- or under-forecasted based mostly on whether or not errors are optimistic or unfavourable, respectively. Determine 9B exhibits the gadgets which have the very best accuracy for a specific Lag forecast over a time frame. We peel the onion (as proven in Determine 9C) to research every merchandise from the desk in Determine 9B as to the way it carried out in comparison with different Lag forecasts throughout the previous interval.

Motion(s): We want to scale back the error for all Lag forecasts and consequently would give attention to poor performers throughout all of those forecasts. One other actionable merchandise is to be taught from the constantly finest performing Lag forecast at any granularity of curiosity and use it for future reference. For instance, if we make the forecast worse going from Lag3Final to Lag2Final to Lag1Final for any merchandise, we could first need to perceive the basis trigger — whether it is deemed to be poor forecast updates not associated to any enterprise anomaly, we could cease updating the forecast after Lag3Final for the actual merchandise in query.