Past forecasting: The fragile steadiness of serving prospects and rising your small business

Firms use time sequence forecasting to make core planning selections that assist them navigate by means of unsure futures. This put up is supposed to handle provide chain stakeholders, who share a typical want of figuring out what number of completed items are wanted over a blended number of planning time horizons. Along with planning what number of items of products are wanted, companies usually must know the place they are going to be wanted, to create a geographically optimum stock.

The fragile steadiness of oversupply and undersupply

If producers produce too few components or completed items, the ensuing undersupply could cause them to make powerful selections of rationing out there sources amongst their buying and selling companions or enterprise items. In consequence, buy orders might have decrease acceptance charges with fewer earnings realized. Additional down the availability chain, if a retailer has too few merchandise to promote, relative to demand, they’ll disappoint buyers attributable to out-of-stocks. When the retail shopper has an instantaneous want, these shortfalls can lead to the acquisition from an alternate retailer or substitutable model. This substitution could be a churn danger if the alternate turns into the brand new default.

On the opposite finish of the availability pendulum, an oversupply of products also can incur penalties. Surplus gadgets should now be carried in stock till bought. A point of security inventory is predicted to assist navigate by means of anticipated demand uncertainty; nonetheless, extra stock results in inefficiencies that may dilute a corporation’s backside line. Particularly when merchandise are perishable, an oversupply can result in the lack of all or a part of the preliminary funding made to amass the sellable completed good.

Even when merchandise will not be perishable, throughout storage they successfully grow to be an idle useful resource that could possibly be out there on the steadiness sheet as free money or used to pursue different investments. Steadiness sheets apart, storage and carrying prices will not be free. Organizations usually have a finite quantity of organized warehouse and logistics capabilities. They need to function inside these constraints, utilizing out there sources effectively.

Confronted with selecting between oversupply and undersupply, on common, most organizations want to oversupply by specific selection. The measurable value of undersupply is usually larger, typically by a number of multiples, when in comparison with the price of oversupply, which we focus on in sections that observe.

The primary cause for the bias in direction of oversupply is to keep away from the intangible value of shedding goodwill with prospects every time merchandise are unavailable. Producers and retailers take into consideration long-term buyer worth and wish to foster model loyalty—this mission helps inform their provide chain technique.

On this part, we examined inequities ensuing from allocating too many or too few sources following a requirement planning course of. Subsequent, we examine time sequence forecasting and the way demand predictions may be optimally matched with item-level provide methods.

Classical approaches to gross sales and operations planning cycles

Traditionally, forecasting has been achieved with statistical strategies that lead to level forecasts, which offer a most-likely worth for the long run. This strategy is usually primarily based on types of transferring averages or linear regression, which seeks to suit a mannequin utilizing an odd least squares strategy. Some extent forecast consists of a single imply prediction worth. As a result of the purpose forecast worth is centered on a imply, it’s anticipated that the true worth will likely be above the imply, roughly 50% of the time. This leaves a remaining 50% of the time when the true quantity will fall beneath the purpose forecast.

Level forecasts could also be attention-grabbing, however they can lead to retailers working out of must-have gadgets 50% of the time if adopted with out skilled evaluate. To stop underserving prospects, provide and demand planners apply handbook judgement overrides or regulate level forecasts by a security inventory components. Firms might use their very own interpretation of a security inventory components, however the thought is to assist guarantee product provide is obtainable by means of an unsure short-term horizon. In the end, planners might want to determine whether or not to inflate or deflate the imply level forecast predictions, in response to their guidelines, interpretations, and subjective view of the long run.

Trendy, state-of-the-art time sequence forecasting allows selection

To fulfill real-world forecasting wants, AWS offers a broad and deep set of capabilities that ship a contemporary strategy to time sequence forecasting. We provide machine studying (ML) providers that embody however will not be restricted to Amazon SageMaker Canvas (for particulars, seek advice from Train a time series forecasting model faster with Amazon SageMaker Canvas Quick build), Amazon Forecast (Start your successful journey with time series forecasting with Amazon Forecast), and Amazon SageMaker built-in algorithms (Deep demand forecasting with Amazon SageMaker). As well as, AWS developed an open-source software program bundle, AutoGluon, which helps various ML duties, together with these within the time sequence area. For extra data, seek advice from Easy and accurate forecasting with AutoGluon-TimeSeries.

Take into account the purpose forecast mentioned within the prior part. Actual-world knowledge is extra sophisticated than may be expressed with a median or a straight regression line estimate. As well as, due to the imbalance of over and undersupply, you want greater than a single level estimate. AWS providers deal with this want by way of ML fashions coupled with quantile regression. Quantile regression lets you choose from a variety of planning situations, that are expressed as quantiles, fairly than depend on single level forecasts. It’s these quantiles that supply selection, which we describe in additional element within the subsequent part.

Forecasts designed to serve prospects and generate enterprise development

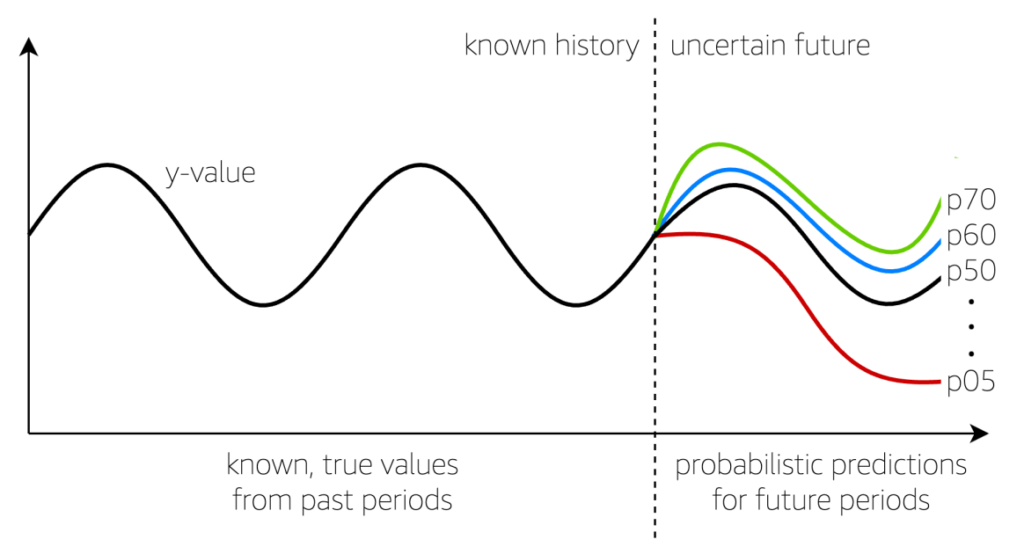

The next determine offers a visible of a time sequence forecast with a number of outcomes, made doable by means of quantile regression. The crimson line, denoted with p05, affords a chance that the true quantity, no matter it could be, is predicted to fall beneath the p05 line, about 5% of the time. Conversely, this implies 95% of the time, the true quantity will doubtless fall above the p05 line.

Subsequent, observe the inexperienced line, denoted with p70. The true worth will fall beneath the p70 line about 70% of the time, leaving a 30% probability it’ll exceed the p70. The p50 line offers a mid-point perspective concerning the future, with a 50/50 probability values will fall above or beneath the p50, on common. These are examples, however any quantile may be interpreted in the identical method.

Within the following part, we look at the right way to measure if the quantile predictions produce an over or undersupply by merchandise.

Measuring oversupply and undersupply from historic knowledge

The earlier part demonstrated a graphical strategy to observe predictions; one other strategy to view them is in a tabular means, as proven within the following desk. When creating time sequence fashions, a part of the info is held again from the coaching operation, which permits accuracy metrics to be generated. Though the long run is unsure, the principle thought right here is that accuracy throughout a holdback interval is the perfect approximation of how tomorrow’s predictions will carry out, all different issues being equal.

The desk doesn’t present accuracy metrics; fairly, it exhibits true values identified from the previous, alongside a number of quantile predictions from p50 by means of p90 in steps of 10. Throughout the current historic 5 time durations, the true demand was 218 items. Quantile predictions provide a spread of values, from a low of 189 items, to a excessive of 314 items. With the next desk, it’s simple to see p50 and p60 lead to an undersupply, and the final three quantiles lead to an oversupply.

We beforehand identified that there’s an asymmetry in over and undersupply. Most companies who make a acutely aware option to oversupply achieve this to keep away from disappointing prospects. The important query turns into: “For the long run forward, which quantile prediction quantity ought to the marketing strategy in opposition to?” Given the asymmetry that exists, a weighted resolution must be made. This want is addressed within the subsequent part the place forecasted portions, as items, are transformed to their respective monetary meanings.

Robotically choosing right quantile factors primarily based on maximizing revenue or customer support objectives

To transform quantile values to enterprise values, we should discover the penalty related to every unit of overstock and with every unit of understock, as a result of these are not often equal. An answer for this want is well-documented and studied within the discipline of operations analysis, known as a newsvendor drawback. Whitin (1955) was the primary to formulate a requirement mannequin with pricing results included. The newsvendor drawback is known as from a time when information sellers needed to determine what number of newspapers to buy for the day. In the event that they selected a quantity too low, they might promote out early and never attain their revenue potential the day. In the event that they selected a quantity too excessive, they had been caught with “yesterday’s information” and would danger shedding a part of their early morning speculative funding.

To compute per-unit the over and underneath penalties, there are just a few items of information vital for every merchandise you want to forecast. You might also improve the complexity by specifying the info as an merchandise+location pair, merchandise+buyer pair, or different combos in response to enterprise want.

- Anticipated gross sales worth for the merchandise.

- All-in value of products to buy or manufacture the merchandise.

- Estimated holding prices related to carrying the merchandise in stock, if unsold.

- Salvage worth of the merchandise, if unsold. If extremely perishable, the salvage worth may strategy zero, leading to a full lack of the unique value of products funding. When shelf steady, the salvage worth can fall wherever underneath the anticipated gross sales worth for the merchandise, relying on the character of a saved and probably aged merchandise.

The next desk demonstrates how the quantile factors had been self-selected from among the many out there forecast factors in identified historic durations. Take into account the instance of merchandise 3, which had a real demand of 1,578 items in prior durations. A p50 estimate of 1,288 items would have undersupplied, whereas a p90 worth of two,578 items would have produced a surplus. Among the many noticed quantiles, the p70 worth produces a most revenue of $7,301. Understanding this, you possibly can see how a p50 choice would lead to a close to $1,300 penalty, in comparison with the p70 worth. This is just one instance, however every merchandise within the desk has a singular story to inform.

Answer overview

The next diagram illustrates a proposed workflow. First, Amazon SageMaker Data Wrangler consumes backtest predictions produced by a time sequence forecaster. Subsequent, backtest predictions and identified actuals are joined with monetary metadata on an merchandise foundation. At this level, utilizing backtest predictions, a SageMaker Information Wrangler rework computes the unit value for underneath and over forecasting per merchandise.

SageMaker Information Wrangler interprets the unit forecast right into a monetary context and mechanically selects the item-specific quantile that gives the best quantity of revenue amongst quantiles examined. The output is a tabular set of information, saved on Amazon S3, and is conceptually just like the desk within the earlier part.

Lastly, a time sequence forecaster is used to supply future-dated forecasts for future durations. Right here, you might also select to drive inference operations, or act on inference knowledge, in response to which quantile was chosen. This may occasionally assist you to cut back computational prices whereas additionally eradicating the burden of handbook evaluate of each single merchandise. Specialists in your organization can have extra time to concentrate on high-value gadgets whereas hundreds of things in your catalog can have computerized changes utilized. As a degree of consideration, the long run has some extent of uncertainty. Nonetheless, all different issues being equal, a blended choice of quantiles ought to optimize outcomes in an total set of time sequence. Right here at AWS, we advise you to make use of two holdback prediction cycles to quantify the diploma of enhancements discovered with blended quantile choice.

Answer steerage to speed up your implementation

In case you want to recreate the quantile choice resolution mentioned on this put up and adapt it to your individual dataset, we offer an artificial pattern set of information and a pattern SageMaker Information Wrangler circulation file to get you began on GitHub. The whole hands-on expertise ought to take you lower than an hour to finish.

We offer this put up and pattern resolution steerage to assist speed up your time to market. The first enabler for recommending particular quantiles is SageMaker Information Wrangler, a purpose-built AWS service meant to scale back the time it takes to arrange knowledge for ML use circumstances. SageMaker Information Wrangler offers a visible interface to design knowledge transformations, analyze knowledge, and carry out function engineering.

In case you are new to SageMaker Information Wrangler, seek advice from Get Started with Data Wrangler to know the right way to launch the service by means of Amazon SageMaker Studio. Independently, we’ve got greater than 150 blog posts that assist uncover various pattern knowledge transformations addressed by the service.

Conclusion

On this put up, we mentioned how quantile regression allows a number of enterprise resolution cut-off dates sequence forecasting. We additionally mentioned the imbalanced value penalties related to over and underneath forecasting—usually the penalty of undersupply is a number of multiples of the oversupply penalty, to not point out undersupply could cause the lack of goodwill with prospects.

The put up mentioned how organizations can consider a number of quantile prediction factors with a consideration for the over and undersupply prices of every merchandise to mechanically choose the quantile doubtless to supply essentially the most revenue in future durations. When vital, you possibly can override the choice when enterprise guidelines want a hard and fast quantile over a dynamic one.

The method is designed to assist meet enterprise and monetary objectives whereas eradicating the friction of getting to manually apply judgment calls to every merchandise forecasted. SageMaker Information Wrangler helps the method run on an ongoing foundation as a result of quantile choice have to be dynamic with altering real-world knowledge.

It ought to be famous that quantile choice isn’t a one-time occasion. The method ought to be evaluated throughout every forecasting cycle as effectively, to account for modifications together with elevated value of products, inflation, seasonal changes, new product introduction, shifting client calls for, and extra. The proposed optimization course of is positioned after the time sequence mannequin era, known as the mannequin coaching step. Quantile alternatives are made and used with the long run forecast era step, typically known as the inference step.

If in case you have any questions on this put up or would really like a deeper dive into your distinctive organizational wants, please attain out to your AWS account crew, your AWS Options Architect, or open a brand new case in our help middle.

References

- DeYong, G. D. (2020). The worth-setting newsvendor: evaluate and extensions. Worldwide Journal of Manufacturing Analysis, 58(6), 1776–1804.

- Liu, C., Letchford, A. N., & Svetunkov, I. (2022). Newsvendor issues: An built-in technique for estimation and optimisation. European Journal of Operational Analysis, 300(2), 590–601.

- Punia, S., Singh, S. P., & Madaan, J. Okay. (2020). From predictive to prescriptive analytics: A knowledge-driven multi-item newsvendor mannequin. Choice Help Programs, 136.

- Trapero, J. R., Cardós, M., & Kourentzes, N. (2019). Quantile forecast optimum mixture to boost security inventory estimation. Worldwide Journal of Forecasting, 35(1), 239–250.

- Whitin, T. M. (1955). Stock management and value principle. Administration Sci. 2 61–68.

In regards to the Writer

Charles Laughlin is a Principal AI/ML Specialist Answer Architect and works within the Amazon SageMaker service crew at AWS. He helps form the service roadmap and collaborates each day with various AWS prospects to assist rework their companies utilizing cutting-edge AWS applied sciences and thought management. Charles holds a M.S. in Provide Chain Administration and a Ph.D. in Information Science.

Charles Laughlin is a Principal AI/ML Specialist Answer Architect and works within the Amazon SageMaker service crew at AWS. He helps form the service roadmap and collaborates each day with various AWS prospects to assist rework their companies utilizing cutting-edge AWS applied sciences and thought management. Charles holds a M.S. in Provide Chain Administration and a Ph.D. in Information Science.