Quick Provide of HPC GPUs to Persist for 1.5 Years

The experiences about an inadequate provide of compute GPUs used for synthetic intelligence (AI) and high-performance computing (HPC) servers grew to become widespread in current months as demand for GPUs to energy generative AI functions exploded. TSMC admits that the largest compute GPU provide bottleneck is its chip-on-wafer-on-substrate (CoWoS) packaging capability, as it’s utilized by just about everybody within the AI and HPC enterprise. The corporate is increasing CoWoS capability however believes that its scarcity will persist for 1.5 years.

“It is just not the scarcity of AI chips,” stated Mark Liu, the chairman of TSMC, in a dialog with Nikkei. “It is the scarcity of our CoWoS capability. […] At present, we can’t fulfill 100% of our clients’ wants, however we attempt to assist about 80%. We expect it is a short-term phenomenon. After our growth of [advanced chip packaging capacity], it needs to be alleviated in a single and a half years.“

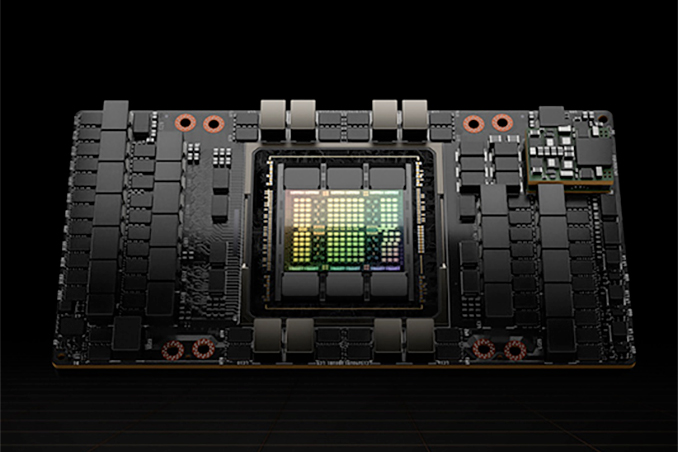

TSMC at the moment produces the overwhelming majority of processors that energy in style AI companies, together with compute GPUs (comparable to AMD’s Intuition MI250 and NVIDIA’s A100 and H100), FPGAs, and specialised ASICs from firms like d-Matrix and Tenstorrent in addition to proprietary processors from cloud service suppliers, comparable to AWS’s Trainium and Inferentia in addition to Google’s TPU.

It’s noteworthy that compute GPUs, FPGAs, and accelerators from CSPs all use HBM reminiscence to get the very best bandwidth doable and use TSMC’s interposer-based chip-on-wafer-on-substrate packaging. Whereas conventional outsourced semiconductor meeting and check (OSAT) firms like ASE and Amkor additionally supply comparable packaging applied sciences, it appears like TSMC is getting the lion’s share of the orders, which is why it could barely meet demand for its packaging companies.

Trade analysts imagine that OSATs are much less motivated to supply superior packaging companies as a result of it requires them to take a position hefty quantities of capital and poses extra monetary dangers than conventional packaging. For instance, if one thing goes flawed with a mainstream processor that sits on an natural substrate, an OSAT loses just one chip, whereas if one thing goes flawed with a bundle carrying 4 chiplets and eight HBM reminiscence stacks, the corporate loses tons of if not 1000’s of {dollars}. Since OSATs don’t get substantial margins making these chiplets, such dangers decelerate the growth of superior packaging capability at OSATs, despite the fact that superior packaging prices considerably more cash than conventional packaging.

Similar to its business friends, TSMC is spending billions on upcoming superior packaging amenities. For instance, the corporate not too long ago introduced plans to spend nearly $2.9 billion on a packaging fab that’s rumored to return on-line in 2027.

“We’re rising our capability as rapidly as doable,” stated C.C. Wei, chief government of TSMC, on the firm’s earnings name earlier this 12 months. “We count on these tightness considerably be launched in subsequent 12 months, in all probability in the direction of the top of subsequent 12 months. […] I cannot provide the precise quantity [in terms of processed wafers capacity], however CoWoS [capacity will be doubled in 2024 vs. 2023].“

Supply: Nikkei