Automate doc validation and fraud detection within the mortgage underwriting course of utilizing AWS AI companies: Half 1

On this three-part collection, we current an answer that demonstrates how one can automate detecting doc tampering and fraud at scale utilizing AWS AI and machine studying (ML) companies for a mortgage underwriting use case.

This resolution rides on a extra important world wave of accelerating mortgage fraud, which is worsening as extra folks current fraudulent proofs to qualify for loans. Knowledge suggests high-risk and suspected fraudulent mortgage exercise is on the rise, noting a 52% enhance in suspected fraudulent mortgage functions since 2013. (Supply: Equifax)

Half 1 of this collection discusses the commonest challenges related to the guide lending course of. We offer concrete steerage on addressing this concern with AWS AI and ML companies to detect doc tampering, determine and categorize patterns for fraudulent situations, and combine with business-defined guidelines whereas minimizing human experience for fraud detection.

In Half 2, we reveal methods to practice and host a pc imaginative and prescient mannequin for tampering detection and localization on Amazon SageMaker. In Half 3, we present methods to automate detecting fraud in mortgage paperwork with an ML mannequin and business-defined guidelines utilizing Amazon Fraud Detector.

Challenges related to the guide lending course of

Organizations within the lending and mortgage business obtain hundreds of functions, starting from new mortgage functions to refinancing an current mortgage. These paperwork are more and more prone to doc fraud as fraudsters try to use the system and qualify for mortgages in a number of unlawful methods. To be eligible for a mortgage, the applicant should present the lender with paperwork verifying their employment, belongings, and money owed. Altering borrowing guidelines and rates of interest can drastically alter an applicant’s credit score affordability. Fraudsters vary from blundering novices to near-perfect masters when creating fraudulent mortgage software paperwork. Fraudulent paperwork contains however is just not restricted to altering or falsifying paystubs, inflating details about earnings, misrepresenting job standing, and forging letters of employment and different key mortgage underwriting paperwork. These fraud makes an attempt could be difficult for mortgage lenders to seize.

The numerous challenges related to the guide lending course of embrace however not restricted to:

- The need for a borrower to go to the department

- Operational overhead

- Knowledge entry errors

- Automation and time to decision

Lastly, the underwriting course of, or the evaluation of creditworthiness and the mortgage choice, takes extra time if carried out manually. Once more, the guide client lending course of has some benefits, resembling approving a mortgage that requires human judgment. The answer will present automation and threat mitigation in mortgage underwriting which can assist cut back time and price as in comparison with the guide course of.

Answer overview

Doc validation is a essential sort of enter for mortgage fraud choices. Understanding the danger profile of the supporting mortgage paperwork and driving insights from this knowledge can considerably enhance threat choices and is central to any underwriter’s fraud administration technique.

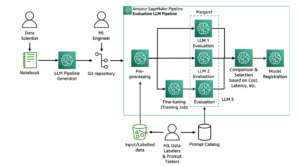

The next diagram represents every stage in a mortgage doc fraud detection pipeline. We stroll by every of those phases and the way they support in direction of underwriting accuracy (initiated with capturing paperwork to categorise and extract required content material), detecting tampered paperwork, and at last utilizing an ML mannequin to detect potential fraud labeled based on business-driven guidelines.

Within the following sections, we focus on the phases of the method intimately.

Doc classification

With intelligent document processing (IDP), we will routinely course of monetary paperwork utilizing AWS AI companies resembling Amazon Textract and Amazon Comprehend.

Moreover, we will use the Amazon Textract Analyze Lending API in processing mortgage paperwork. Analyze Lending makes use of pre-trained ML fashions to routinely extract, classify, and validate info in mortgage-related paperwork with excessive velocity and accuracy whereas decreasing human error. As depicted within the following determine, Analyze Lending receives a mortgage doc after which splits it into pages, classifying them based on the kind of doc. The doc pages are then routinely routed to Amazon Textract textual content processing operations for correct knowledge extraction and evaluation.

The Analyze Lending API presents the next advantages:

- Automated end-to-end processing of mortgage packages

- Pre-trained ML fashions throughout quite a lot of doc varieties in a mortgage software bundle

- Skill to scale on demand and cut back reliance on human reviewers

- Improved decision-making and considerably decrease working prices

Tampering detection

We use a pc imaginative and prescient mannequin deployed on SageMaker for our end-to-end picture forgery detection and localization resolution, which suggests it takes a testing picture as enter and predicts pixel-level forgery chance as output.

Most analysis research give attention to 4 picture forgery strategies: splicing, copy-move, elimination, and enhancement. Each splicing and copy-move contain including picture content material to the goal (cast) picture. Nevertheless, the added content material is obtained from a unique picture in splicing. In copy-move, it’s from the goal picture. Removing, or inpainting, removes a specific picture area (for instance, hiding an object) and fills the area with new pixel values estimated from the background. Lastly, picture enhancement is an enormous assortment of native manipulations, resembling sharpening, brightness, and adjustment.

Relying on the traits of the forgery, totally different clues can be utilized as the muse for detection and localization. These clues embrace JPEG compression artifacts, edge inconsistencies, noise patterns, coloration consistency, visible similarity, EXIF consistency, and digital camera mannequin. Nevertheless, real-life forgeries are extra advanced and infrequently use a sequence of manipulations to cover the forgery. Most current strategies give attention to image-level detection, whether or not or not a picture is cast, and never on localizing or highlighting a cast space of the doc picture to assist the underwriter in making knowledgeable choices.

We stroll by the implementation particulars of coaching and internet hosting a pc imaginative and prescient mannequin for tampering detection and localization on SageMaker in Half 2 of this collection. The conceptual CNN-based structure of the mannequin is depicted within the following diagram. The mannequin extracts picture manipulation hint options for a testing picture and identifies anomalous areas by assessing how totally different an area characteristic is from its reference options. It detects cast pixels by figuring out native anomalous options as a predicted masks of the testing picture.

Fraud detection

We use Amazon Fraud Detector, a completely managed AI service, to automate the era, analysis, and detection of fraudulent actions. That is achieved by producing fraud predictions primarily based on knowledge extracted from the mortgage paperwork in opposition to ML fraud fashions educated with the shopper’s historic (fraud) knowledge. You should utilize the prediction to set off enterprise guidelines in relation to underwriting choices.

Defining the fraud prediction logic includes the next parts:

- Occasion varieties – Outline the construction of the occasion

- Fashions – Outline the algorithm and knowledge necessities for predicting fraud

- Variables – Characterize a knowledge ingredient related to the fraud detection occasion

- Guidelines – Inform Amazon Fraud Detector methods to interpret the variable values throughout fraud prediction

- Outcomes – The outcomes generated from a fraud prediction

- Detector model – Incorporates fraud prediction logic for the fraud detection occasion

The next diagram illustrates the structure of this part.

After you deploy your mannequin, you could consider its efficiency scores and metrics primarily based on the prediction explanations. This helps determine prime threat indicators and analyze fraud patterns throughout the information.

Third-party validation

We combine the answer with third-party suppliers (through API) to validate the extracted info from the paperwork, resembling private and employment info. That is notably helpful to cross-validate particulars along with doc tampering detection and fraud detection primarily based on the historic sample of functions.

The next structure diagram illustrates a batch-oriented fraud detection pipeline in mortgage software processing utilizing varied AWS companies.

The workflow contains the next steps:

- The consumer uploads the scanned paperwork into Amazon Simple Storage Service (Amazon S3).

- The add triggers an AWS Lambda perform (Invoke Doc Evaluation) that calls the Amazon Textract API for textual content extraction. Moreover, we will use the Amazon Textract Analyze Lending API to routinely extract, classify, and validate info.

- On completion of textual content extraction, a notification is shipped through Amazon Simple Notification Service (Amazon SNS).

- The notification triggers a Lambda perform (Get Doc Evaluation), which invokes Amazon Comprehend for customized doc classification.

- Doc evaluation outcomes which have a low confidence rating to are routed to human reviewers utilizing Amazon Augmented AI (Amazon A2I).

- Output from Amazon Textract and Amazon Comprehend is aggregated utilizing a Lambda perform (Analyze & Classify Doc).

- A SageMaker inference endpoint known as for a fraud prediction masks of the enter paperwork.

- Amazon Fraud Detector known as for a fraud prediction rating utilizing the information extracted from the mortgage paperwork.

- The outcomes from Amazon Fraud Detector and the SageMaker inference endpoint are aggregated into the mortgage origination software.

- The standing of the doc processing job is tracked in Amazon DynamoDB.

Conclusion

This publish walked by an automatic resolution to detect doc tampering and fraud within the mortgage underwriting course of utilizing Amazon Fraud Detector and different Amazon AI and ML companies. This resolution means that you can detect fraudulent makes an attempt nearer to the time of fraud incidence and helps underwriters with an efficient decision-making course of. The pliability of the implementation means that you can outline business-driven guidelines to categorise and seize the fraudulent makes an attempt custom-made to particular enterprise wants.

In Half 2 of this collection, we offer the implementation particulars for detecting doc tampering utilizing SageMaker. In Half 3, we reveal methods to implement the answer on Amazon Fraud Detector.

Concerning the authors

Anup Ravindranath is a Senior Options Architect at Amazon Net Companies (AWS) primarily based in Toronto, Canada working with Monetary Companies organizations. He helps clients to remodel their companies and innovate on cloud.

Anup Ravindranath is a Senior Options Architect at Amazon Net Companies (AWS) primarily based in Toronto, Canada working with Monetary Companies organizations. He helps clients to remodel their companies and innovate on cloud.

Vinnie Saini is a Senior Options Architect at Amazon Net Companies (AWS) primarily based in Toronto, Canada. She has been serving to Monetary Companies clients rework on cloud, with AI and ML pushed options laid on sturdy foundational pillars of Architectural Excellence.

Vinnie Saini is a Senior Options Architect at Amazon Net Companies (AWS) primarily based in Toronto, Canada. She has been serving to Monetary Companies clients rework on cloud, with AI and ML pushed options laid on sturdy foundational pillars of Architectural Excellence.