Greater Issues to Come as NV Approaches $1T Market Cap

Closing out the latest earnings season for the PC trade is, as all the time, NVIDIA. The corporate’s uncommon, practically year-ahead fiscal calendar signifies that they get the good thing about being casually late in reporting their outcomes. And on this case, they’ve ended up being the proverbial case of saving the perfect for final.

For the primary quarter of their 2024 fiscal 12 months, NVIDIA booked $7.2 billion in income, which is a 13% drop over the year-ago quarter. Like the remainder of the chip trade, NVIDIA has been weathering a major stoop in demand for computing merchandise over the previous few quarters, which in flip has dented NVIDIA’s income and profitability. Nevertheless, whereas NVIDIA’s consumer-focused gaming division has continued to take issues on the chin, the sturdy efficiency of NVIDIA’s knowledge middle group has stored the corporate as a complete pretty worthwhile, with the latest quarter setting a section report and serving to NVIDIA to keep away from the robust monetary conditions confronted by rivals AMD and Intel.

| NVIDIA Q1 FY2024 Monetary Outcomes (GAAP) | |||||

| Q1 FY2024 | This autumn FY2023 | Q1 FY2023 | Q/Q | Y/Y | |

| Income | $7.2B | $6.1B | $8.3B | +19% | -13% |

| Gross Margin | 64.6% | 63.3% | 65.5% | +1.3ppt | -0.9ppt |

| Working Revenue | $2.1B | $1.3B | $1.9B | +70% | +15% |

| Web Revenue | $2.0B | $1.4B | $1.6B | +44% | +26% |

| EPS | $0.82 | $0.57 | $0.64 | +44% | +28% |

To that finish, whereas Q1’FY24 was not by any means a report quarter for NVIDIA, it was nonetheless a comparatively sturdy one for the corporate. NVIDIA’s internet earnings of $2 billion makes for one among their higher quarters in that regard, and it’s really up 26% year-over-year regardless of the income drop. That mentioned, studying between the strains will discover that NVIDIA paid their Arm acquisition breakup charge final 12 months (Q1’FY23), so NVIDIA’s GAAP internet earnings appears to be like a bit higher than it in any other case would; whereas non-GAAP internet earnings can be down 21%. In the meantime, NVIDIA’s gross margins have held sturdy in the latest quarter, with NVIDIA posting a GAAP gross margin of 64.6%.

However even a strong quarter throughout an trade stoop is arguably not the largest information to return out of NVIDIA’s most up-to-date earnings report. Slightly, it’s the corporate’s projections for Q2’FY24. In brief, NVIDIA is anticipating income to blow up in Q2, with the corporate forecasting $11 billion in gross sales. Ought to it come to fruition, such 1 / 4 would blow properly previous NVIDIA’s earlier income data – and shattering Wall Avenue expectations. Because of this, NVIDIA’s inventory has already taken off in in a single day buying and selling, and by the point the market opens a bit later this morning, NVIDIA is anticipated to be a $930B+ firm, knocking on the door of crossing a market capitalization of a trillion {dollars}.

NVIDIA Reporting Section Outcomes

| NVIDIA Section Outcomes, Q1 FY2024 (GAAP) | |||||

| Q1 FY2024 | This autumn FY2023 | Q1 FY2023 | Q/Q | Y/Y | |

| Information Heart | $4,284M | $3,616M | $3,750M | +18% | +14% |

| Gaming | $2,240M | $1,831M | $3,620M | +22% | -38% |

| Skilled Visualization | $295M | $226M | $622M | +31% | -53% |

| Automotive | $296M | $294M | $138M | +1% | +114% |

| OEM & IP | $77M | $84M | $158M | -8% | -51% |

However first issues first, let’s check out the efficiency of NVIDIA’s particular person segments. The bellwether of NVIDIA’s product portfolio over the latest quarter was unambiguously the corporate’s knowledge middle section, which booked $4.3B in income. The info middle section is doing many of the heavy lifting for NVIDIA’s income proper now, as the opposite main section, gaming, and many of the minor segments are all down year-over-year. Compared to these different segments, knowledge middle income wasn’t simply up 14% year-over-year, nevertheless it set a brand new report for the corporate.

This additionally marked the primary quarter the place NVIDIA’s knowledge middle income eclipsed Intel’s knowledge middle income – although it could very properly have been a fluke based mostly on an unusually weak quarter from Intel forward of upper quantity shipments of Sapphire Rapids CPUs. Both approach, quarters like these underscore why all three of the massive PC chip makers are chasing after the information middle market, because the profitability considerably eclipses the buyer market.

Encompassing each NVIDIA’s knowledge middle compute merchandise (GPUs, CPUs, and so on) in addition to NVIDIA’s ex-Mellanox networking merchandise, NVIDIA is attributing many of the development of this section to rising demand for GPUs to be used with massive language fashions (LLMs) and different varieties of generative AI. As hinted at by the explosion in public curiosity in ChatGPT and different merchandise late final 12 months – and the next knock-on impact it’s had on NVIDIA’s knowledge middle GPU gross sales – main expertise firms appear to be investing considerably in snapping up GPUs for AI coaching and inference. NVIDIA is reporting that cloud service suppliers and shopper web firms have been the massive drivers of development, leaving enterprise gross sales as extra constant, and networking gross sales have been down versus the year-ago quarter.

NVIDIA, in flip, is anticipating the demand for his or her knowledge middle merchandise to stay sturdy, whilst they proceed to ramp up the manufacturing of H100 HPC accelerators, L-series server playing cards, and the primary Grace CPU-based merchandise. Because of this, the expectations for NVIDIA’s knowledge middle section are very excessive, as NVIDIA is in a particularly favorable place given the demand for server and knowledge middle GPUs – maybe much more so than the height of the latest cryptocurrency growth.

NVIDIA’s consumer-focused gaming division, however, was extra of a combined bag. At $2.2B in income, gross sales of GeForce and different playing cards have been down considerably over what was largely the ultimate quarter of the cryptocurrency growth and the general pandemic-boosted rush on compute merchandise within the shopper area. The 38% YoY drop comes as NVIDIA’s direct prospects are nonetheless drawing down their product inventories (significantly now last-gen RTX 30 sequence components), and RTX 40 sequence shipments are nonetheless choosing up with the launch of bigger components of the product stack for desktops and laptops.

Nonetheless, $2.2B in gaming income really beat some analyst expectations for the section. So whereas NVIDIA’s gaming gross sales are down considerably, they’re apparently down a bit lower than trade watchers have been anticipating.

Shifting down the record, NVIDIA’s skilled visualization section largely follows their gaming section in each good occasions and dangerous. So with revenues down 53% to $295M on a year-over-year foundation, the latest quarter was an particularly tough one. Companions are nonetheless doing stock draw-downs, although the introduction of latest merchandise helps to show issues round.

The automotive section, however, was NVIDIA’s different development section for the quarter, with revenues leaping 114% for the quarter to $296M. Whereas this section has nonetheless but to turn into a break-out section for NVIDIA, gross sales have been trying constantly higher because the launch of their Orin platform and the related bounce in total gross sales.

Lastly, NVIDIA’s OEM & Different section was one other that noticed important declines, dropping 51% to $77M. Based on the corporate, this was primarily pushed by decrease gross sales of entry-level GeForce MX GPUs.

Wanting Ahead: Aiming to Beat NVIDIA’s FY2020 Income in a Single Quarter

However for as strong as NVIDIA’s Q1 report was in an in any other case tepid expertise market, the opposite half of the story regarding their newest earnings launch comes from what’s going to occur subsequent. Or relatively, what NVIDIA is projecting.

For the second quarter of their 2024 fiscal 12 months, NVIDIA is projecting $11 billion (plus or minus 2%) in income. This may be a large, 64% year-over-year bounce in whole income for the corporate, and an almost as massive 53% improve over Q1. And, as NVIDIA tells it, it’s not going to be a fluke.

Driving this huge bounce in income is anticipated to be a growth in NVIDIA knowledge middle product gross sales, particularly as manufacturing of NVIDIA’s high-end knowledge middle merchandise continues to ramp. Enterprise curiosity in AI has already created important demand for the H100 and different accelerators, and that demand isn’t anticipated to abate any time quickly as NVIDIA assembles an ever-larger variety of accelerators. As a way to sustain, the comapny has already ordered “considerably extra” GPUs for the second half of the 12 months, based mostly on that preliminary growth in demand.

All pithiness apart, synthetic intelligence is clearly the expansion driver for the information middle market throughout the complete trade proper now, and NVIDIA’s management over the lion’s share of that market has them standing to profit probably the most from the demand.

If NVIDIA’s $11 billion quarter involves move, then it would result in NVIDIA reserving as a lot income as in all of FY2020 – or if you wish to go to pre-pandemic occasions, FY 2018. All of which is important development for what was already a really massive firm earlier than the pandemic.

That $11 billion quarter projection has additionally blown previous analysts’ expectations for the quarter, which previous to the announcement have been on the order of $7.2 billion.

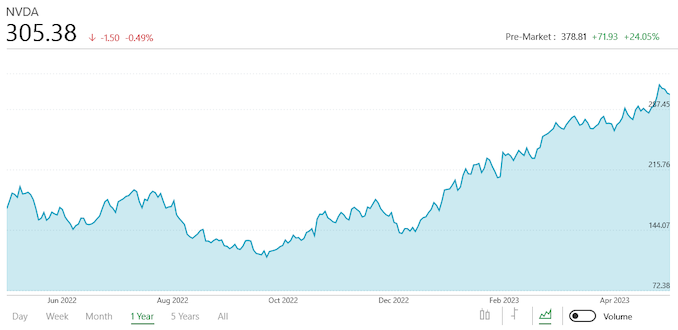

Because of this, NVIDIA’s inventory value spiked nearly the second they made their earnings launch – and has stayed that prime in a single day – as buyers adapt to new income expectations for NVIDIA. At about an hour earlier than the inventory market opens, NVIDIA’s inventory is up $78 to $385, a 26% bounce, and one with only a few precedents even throughout the wild tech trade.

NVIDIA 10 12 months Market Capitalization (StockAnalysis.com)

The massive bounce in NVIDIA’s inventory value can be driving up NVIDIA’s market capitalization. When the markets open, NVIDIA is anticipated to open as a $930+ billion firm, $175B+ increased than its market capitalization the evening earlier than. To place issues in perspective, that’s a whole AMD ($174B) in market capitalization development, or a complete Intel ($121B) with change to spare.

This can even put NVIDIA on the doorstep of turning into the following trillion greenback firm, a really elite membership that, in keeping with Bloomberg, solely eight firms have hit earlier than (and solely 5 firms are members of now). NVIDIA is already probably the most helpful chipmaker (fabless or in any other case) by leaps and bounds, and this bounce in market capitalization will additional develop that hole.

However no matter whether or not NVIDIA hits the $1 trillion mark or not, the corporate’s newest earnings report and subsequent inventory value rally underscore the worth of AI infrastructure – perceived or in any other case. The remainder of the trade is keen to guarantee that the story of synthetic intelligence is just not the story of NVIDIA, and to that finish we must always count on loads of AI-related information and {hardware} developments to return.