A Report Shedding Quarter Goes Higher Than Anticipated

Kicking off our protection of the primary earnings season of the yr for the tech trade, we as all the time begin with Intel. The blue-hued blue-chip is the primary out of the gate to report their outcomes for the primary quarter of 2023, with Intel choosing up the items after a tough finish to 2023, and a relatively painful begin to 2023. With income down on a yearly foundation nearly throughout the complete board because of a serious, trade large stoop in consumer and server gross sales, Intel’s focus has been on battening down the hatches to climate this tough interval, whereas making ready for an eventual (if modest) upturn available in the market later this yr.

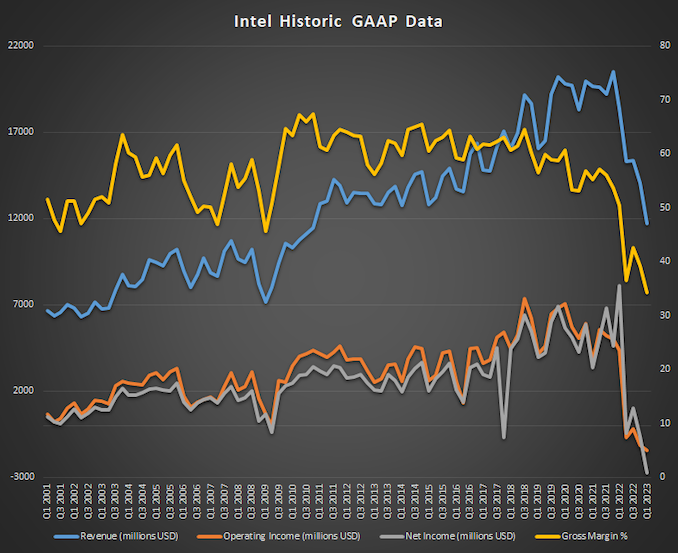

For the primary quarter of 2023, Intel booked $11.7B in income, a precipitous 36% drop from the year-ago quarter. As was the case in This autumn, Intel is within the midst of a serious trade stoop, which has hit revenues onerous and working/web incomes even tougher. Intel closed the quarter within the pink on an working earnings foundation, shedding $1.5B, and the corporate’s total web loss was a staggering $2.8B on a GAAP foundation.

| Intel Q1 2023 Monetary Outcomes (GAAP) | ||||||

| Q1’2023 | This autumn’2022 | Q1’2022 | Y/Y | |||

| Income | $11.7B | $14.0B | $18.4B | -36% | ||

| Working Revenue | -$1.5B | -$1.1B | $4.3B | -134% | ||

| Web Revenue | -$2.8B | -$661M | $8.1B | -134% | ||

| Gross Margin | 34.2% | 39.2% | 50.4% | -16.2 ppt | ||

| Consumer Computing Group | $5.8B | $6.6B | $9.3B | -38% | ||

| Datacenter and AI Group | $3.7B | $4.3B | $6.0B | -39% | ||

| Community and Edge Group | $1.5B | $2.1B | $2.1B | -30% | ||

| Mobileye | $458M | $565M | $394M | +16% | ||

| Intel Foundry Providers | $118M | $319M | $156M | -24% | ||

Because of this, Q1’2023 is a report shedding quarter for Intel, with the corporate posting its greatest loss ever recorded. Even amidst the corporate’s many ups and downs during the last 54 years, the corporate has by no means misplaced greater than a billion {dollars} in 1 / 4, not to mention over two billion. Admittedly, a part of that is structural – restructuring costs, share-based compensation prices, earnings taxes, and different non-core components contributed over $2 billion in GAAP web losses – however the measurement remains to be staggering.

Consequently, Intel’s extremely vaunted gross margin dropped to simply 34.2%, its lowest in at the very least 20 years.

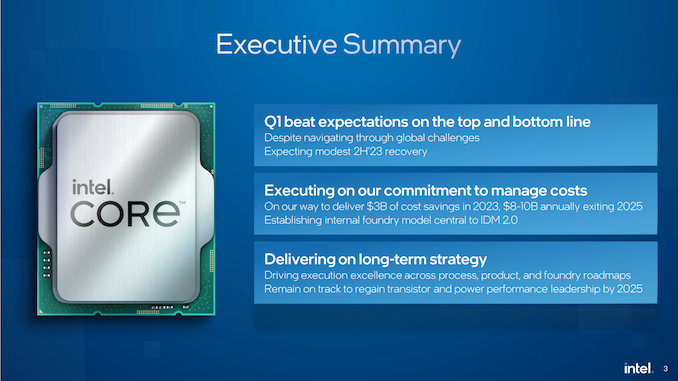

And but, regardless of all of this, this quarter went higher than anticipated for Intel. The corporate had warned traders early-on that it could be brutal, and whereas Intel delivered on these guarantees, it exceeded its income and EPS projections from earlier within the quarter. So whereas the corporate is much from being out of its present stoop, there are some indicators that it could be nearing the underside.

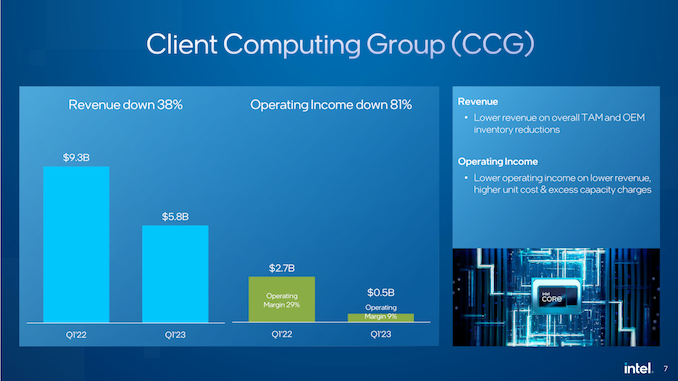

Diving into particular person section efficiency, the Consumer Computing Group (CCG) stays the bellwether for the corporate. Sadly, its additionally one of many segments being hit hardest by the tech spending downturn, with tech firms throughout the globe recalling from a 30%+ drop in PC gross sales.

To that finish, Intel booked $5.8B in consumer income for the quarter, which is down 38% from the year-ago quarter. Regardless of all of this, the CCG maintained a constructive working margin, popping out forward by $0.5B, for a 9% margin. Intel’s detailed report, laptop computer gross sales dropped tougher than desktop gross sales, although each had been down considerably. At this level Intel’s downstream OEM prospects are nonetheless burning via beforehand bought stock, which signifies that Intel is promoting far fewer chips than is common. Intel stopped offering ASP info a while in the past, so it’s unclear how a lot a change in chip pricing can also be an element.

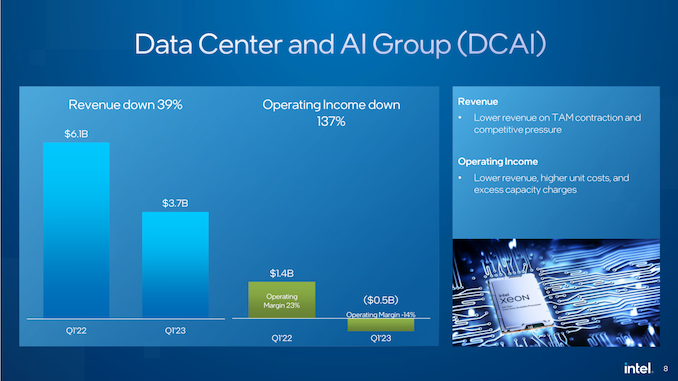

Shifting on, Intel’s Knowledge Middle and AI Group (DCAI) is recovering from issues of its personal. Whereas Intel is now transport its long-overdue Sapphire Rapids processors in quantity, they’re nonetheless ramping up to be able to hit their purpose of 1 million chips bought by mid-year. Within the interim, DCAI gross sales have softened much more than consumer gross sales, with income dropping 39% from the year-ago quarter, regardless of Sapphire Rapids lastly being out the door.

For the quarter, Intel booked simply $3.7 billion in DCAI income. Which on an operational foundation interprets to a $518M loss for the corporate. The truth that Intel took a loss on its knowledge heart section is exceptional, though not for good causes. Whereas the information heart/server enterprise has been reconfigured a number of instances during the last decade, I can not recollect it ever working at a loss – and checking around, this appears to be appropriate. Regardless of being what’s historically Intel’s highest margin enterprise unit, Intel was unable to eek out even an operational revenue on server elements for the quarter.

Complicating issues considerably has been one more organizational change inside Intel. The Accelerated Computing and Graphics Group (AXG), which was beforehand a top-line enterprise unit, was cut up up and subsumed late in December by the CCG and DCAI enterprise items, with every taking their respective half of the enterprise. The fashionable incarnation of AXG is now solely centered on datacenter elements, and is part of DCAI. I deliver this up as a result of as a fledgling enterprise unit, AXG itself was working an working loss in 2022. Per Intel’s revised figures to permit for like-for-like, year-over-year comparisons with their revised enterprise items, the mixed enterprise unit shift knocked practically $300M off of DCAI’s working earnings for Q1’2022. There’s no technique to inform what the impression was for 2023, however it appears unlikely that AXG was positively contributing to DCAI’s profitability.

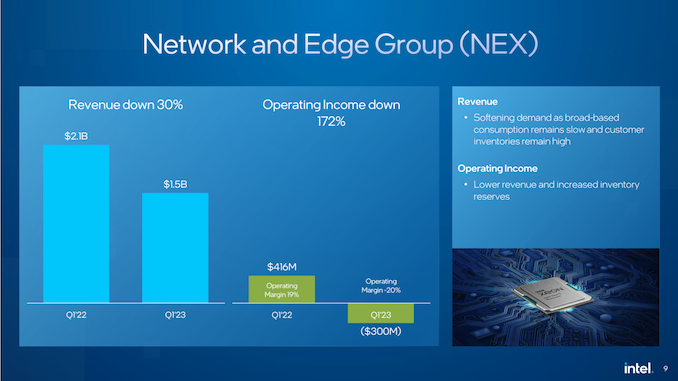

The ultimate of Intel’s large teams is the Community and Edge Group (NEX), which covers Intel’s networking, connectivity, and IoT merchandise, and is the place Intel data gross sales of different silicon corresponding to Xeon SKUs for networking merchandise. NEX has taken an identical hit as Intel’s different top-line teams, with revenues falling 30% to $1.5B. This was sufficient of a drop to additionally push NEX into the pink, shedding $300M for the quarter. Based on feedback from Intel CEO Pat Gelsinger, the NEX buyer base is enacting related stock corrections as among the different chip items, which is able to proceed for a pair extra quarters.

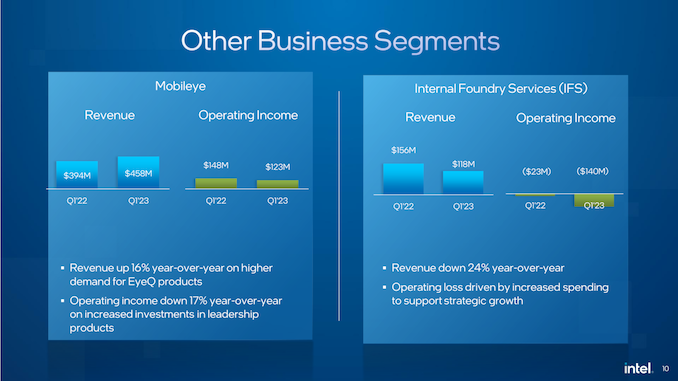

Rounding out Intel’s portfolio, Mobileye was the one distinct vivid spot in Intel’s earnings report. The automotive group has seen income develop year-over-year by 16%, reaching new data for the quarter. And whereas working incomes had been down by 17%, it’s nonetheless working within the black. Intel Foundry Providers (IFS) however was within the pink, although this isn’t surprising as Intel remains to be within the midst of a multi-year funding technique to retake fab efficiency management. Income dropped 24% year-over-year, however Intel has made it clear that IFS is a long-haul prospect that they may proceed to speculate closely in.

Trying ahead, whereas Intel is indicating that elements of its enterprise segments have bottomed out (or practically so), Q1 was not the final unhealthy quarter for Intel. For Q2’2023 the corporate is projecting revenues of $11.5B to $12.5B, which might be a 22% YoY drop. Gross margins are anticipated to drop additional as nicely, to a GAAP gross margin of simply 33.2%. As famous earlier, the corporate is projecting a modest restoration within the second half of the yr, however they may nonetheless need to get via Q2 to get there.

Following Q1, Intel’s main total initiatives stay unchanged, each with reference to product plans and operational bills. As introduced final yr, the corporate is enterprise efforts to considerably reduce bills; and in line with Pat Gelsinger, Intel is “nicely on our approach” in direction of lowering prices by $3B in 2023, reaching an annual financial savings of $8B to $10B by the top of 2025.

In any other case, Intel doesn’t have any main product launches on its public roadmap for Q2 to considerably change the established order. Nevertheless, one vivid spot by way of {hardware} growth is that Intel’s next-generation Intel 4 manufacturing course of and related Meteor Lake consumer CPU have entered manufacturing, with additional ramping happening all year long. As Intel must ship on 5 nodes in 4 years to have a critical likelihood at retaking management within the fab market, it is a promising signal that they’re certainly on monitor.