Automate mortgage doc fraud detection utilizing an ML mannequin and business-defined guidelines with Amazon Fraud Detector: Half 3

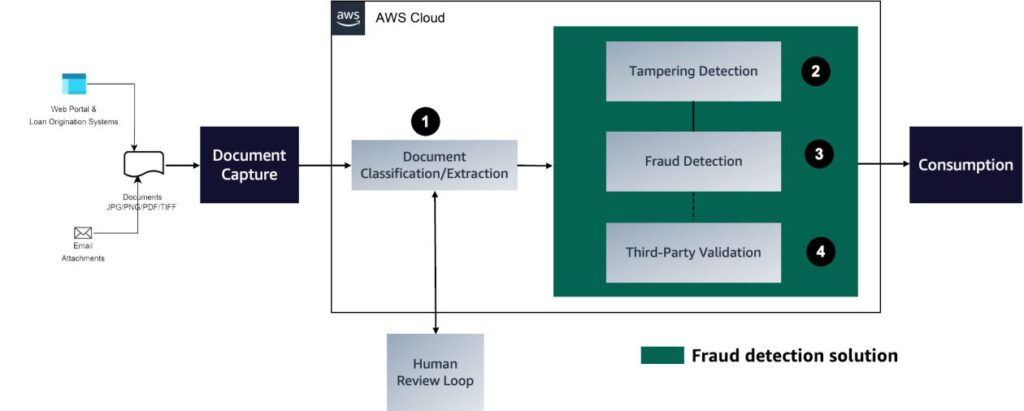

Within the first post of this three-part collection, we offered an answer that demonstrates how one can automate detecting doc tampering and fraud at scale utilizing AWS AI and machine studying (ML) providers for a mortgage underwriting use case.

Within the second post, we mentioned an strategy to develop a deep learning-based laptop imaginative and prescient mannequin to detect and spotlight cast photos in mortgage underwriting.

On this submit, we current an answer to automate mortgage doc fraud detection utilizing an ML mannequin and business-defined guidelines with Amazon Fraud Detector.

Answer overview

We use Amazon Fraud Detector, a completely managed fraud detection service, to automate the detection of fraudulent actions. With an goal to enhance fraud prediction accuracies by proactively figuring out doc fraud, whereas enhancing underwriting accuracies, Amazon Fraud Detector helps you construct personalized fraud detection fashions utilizing a historic dataset, configure personalized choice logic utilizing the built-in guidelines engine, and orchestrate threat choice workflows with the clicking of a button.

The next diagram represents every stage in a mortgage doc fraud detection pipeline.

We’ll now be masking the third element of the mortgage doc fraud detection pipeline. The steps to deploy this element are as follows:

- Add historic information to Amazon Simple Storage Service (Amazon S3).

- Choose your choices and prepare the mannequin.

- Create the mannequin.

- Assessment mannequin efficiency.

- Deploy the mannequin.

- Create a detector.

- Add guidelines to interpret mannequin scores.

- Deploy the API to make predictions.

Stipulations

The next are prerequisite steps for this answer:

- Join an AWS account.

- Arrange permissions that permits your AWS account to entry Amazon Fraud Detector.

- Gather the historic fraud information for use to coach the fraud detector mannequin, with the next necessities:

- Information should be in CSV format and have headers.

- Two headers are required:

EVENT_TIMESTAMPandEVENT_LABEL. - Information should reside in Amazon S3 in an AWS Area supported by the service.

- It’s extremely advisable to run a knowledge profile earlier than you prepare (use an automated data profiler for Amazon Fraud Detector).

- It’s advisable to make use of not less than 3–6 months of information.

- It takes time for fraud to mature; information that’s 1–3 months previous is advisable (not too current).

- Some NULLs and lacking values are acceptable (however too many and the variable is ignored, as mentioned in Missing or incorrect variable type).

Add historic information to Amazon S3

After you may have the customized historic information information to coach a fraud detector mannequin, create an S3 bucket and add the info to the bucket.

Choose choices and prepare the mannequin

The subsequent step in the direction of constructing and coaching a fraud detector mannequin is to outline the enterprise exercise (occasion) to guage for the fraud. Defining an occasion entails setting the variables in your dataset, an entity initiating the occasion, and the labels that classify the occasion.

Full the next steps to outline a docfraud occasion to detect doc fraud, which is initiated by the entity applicant mortgage, referring to a brand new mortgage utility:

- On the Amazon Fraud Detector console, select Occasions within the navigation pane.

- Select Create.

- Underneath Occasion sort particulars, enter

docfraudbecause the occasion sort title and, optionally, enter an outline of the occasion. - Select Create entity.

- On the Create entity web page, enter

applicant_mortgagebecause the entity sort title and, optionally, enter an outline of the entity sort. - Select Create entity.

- Underneath Occasion variables, for Select the way to outline this occasion’s variables, select Choose variables from a coaching dataset.

- For IAM position, select Create IAM position.

- On the Create IAM position web page, enter the title of the S3 bucket together with your instance information and select Create position.

- For Information location, enter the trail to your historic information. That is the S3 URI path that you simply saved after importing the historic information. The trail is much like

S3://your-bucket-name/instance dataset filename.csv. - Select Add.

Variables symbolize information parts that you simply wish to use in a fraud prediction. These variables may be taken from the occasion dataset that you simply ready for coaching your mannequin, out of your Amazon Fraud Detector mannequin’s threat rating outputs, or from Amazon SageMaker fashions. For extra details about variables taken from the occasion dataset, see Get event dataset requirements using the Data models explorer.

- Underneath Labels – optionally available, for Labels, select Create new labels.

- On the Create label web page, enter

fraudbecause the title. This label corresponds to the worth that represents the fraudulent mortgage utility within the instance dataset. - Select Create label.

- Create a second label referred to as

legit. This label corresponds to the worth that represents the legit mortgage utility within the instance dataset. - Select Create occasion sort.

The next screenshot exhibits our occasion sort particulars.

The next screenshot exhibits our variables.

The next screenshot exhibits our labels.

Create the mannequin

After you may have loaded the historic information and chosen the required choices to coach a mannequin, full the next steps to create a mannequin:

- On the Amazon Fraud Detector console, select Fashions within the navigation pane.

- Select Add mannequin, after which select Create mannequin.

- On the Outline mannequin particulars web page, enter

mortgage_fraud_detection_modelbecause the mannequin’s title and an optionally available description of the mannequin. - For Mannequin sort, select the On-line Fraud Insights mannequin.

- For Occasion sort, select

docfraud. That is the occasion sort that you simply created earlier. - Within the Historic occasion information part, present the next info:

- For Occasion information supply, select Occasion information saved uploaded to S3 (or AFD).

- For IAM position, select the position that you simply created earlier.

- For Coaching information location, enter the S3 URI path to your instance information file.

- Select Subsequent.

- Within the Mannequin inputs part, go away all checkboxes checked. By default, Amazon Fraud Detector makes use of all variables out of your historic occasion dataset as mannequin inputs.

- Within the Label classification part, for Fraud labels, select

fraud, which corresponds to the worth that represents fraudulent occasions within the instance dataset. - For Legit labels, select

legit, which corresponds to the worth that represents legit occasions within the instance dataset. - For Unlabeled occasions, preserve the default choice Ignore unlabeled occasions for this instance dataset.

- Select Subsequent.

- Assessment your settings, then select Create and prepare mannequin.

Amazon Fraud Detector creates a mannequin and begins to coach a brand new model of the mannequin.

On the Mannequin variations web page, the Standing column signifies the standing of mannequin coaching. Mannequin coaching that makes use of the instance dataset takes roughly 45 minutes to finish. The standing modifications to Able to deploy after mannequin coaching is full.

Assessment mannequin efficiency

After the mannequin coaching is full, Amazon Fraud Detector validates the mannequin efficiency utilizing 15% of your information that was not used to coach the mannequin and offers numerous instruments, together with a rating distribution chart and confusion matrix, to evaluate mannequin efficiency.

To view the mannequin’s efficiency, full the next steps:

- On the Amazon Fraud Detector console, select Fashions within the navigation pane.

- Select the mannequin that you simply simply skilled (

sample_fraud_detection_model), then select 1.0. That is the model Amazon Fraud Detector created of your mannequin. - Assessment the Mannequin efficiency total rating and all different metrics that Amazon Fraud Detector generated for this mannequin.

Deploy the mannequin

After you may have reviewed the efficiency metrics of your skilled mannequin and are prepared to make use of it generate fraud predictions, you’ll be able to deploy the mannequin:

- On the Amazon Fraud Detector console, select Fashions within the navigation pane.

- Select the mannequin

sample_fraud_detection_model, after which select the particular mannequin model that you simply wish to deploy. For this submit, select 1.0. - On the Mannequin model web page, on the Actions menu, select Deploy mannequin model.

On the Mannequin variations web page, the Standing exhibits the standing of the deployment. The standing modifications to Lively when the deployment is full. This means that the mannequin model is activated and accessible to generate fraud predictions.

Create a detector

After you may have deployed the mannequin, you construct a detector for the docfraud occasion sort and add the deployed mannequin. Full the next steps:

- On the Amazon Fraud Detector console, select Detectors within the navigation pane.

- Select Create detector.

- On the Outline detector particulars web page, enter

fraud_detectorfor the detector title and, optionally, enter an outline for the detector, similar to my pattern fraud detector. - For Occasion Kind, select

docfraud. That is the occasion that you simply created in earlier. - Select Subsequent.

Add guidelines to interpret

After you may have created the Amazon Fraud Detector mannequin, you should use the Amazon Fraud Detector console or utility programming interface (API) to outline business-driven guidelines (situations that inform Amazon Fraud Detector the way to interpret mannequin efficiency rating when evaluating for fraud prediction). To align with the mortgage underwriting course of, you might create guidelines to flag mortgage purposes in line with the chance ranges related and mapped as fraud, legit, or if a assessment is required.

For instance, you might wish to mechanically decline mortgage purposes with a excessive fraud threat, contemplating parameters like tampered photos of the required paperwork, lacking paperwork like paystubs or revenue necessities, and so forth. However, sure purposes might have a human within the loop for making efficient choices.

Amazon Fraud Detector makes use of the aggregated worth (calculated by combining a set of uncooked variables) and uncooked worth (the worth offered for the variable) to generate the mannequin scores. The mannequin scores may be between 0–1000, the place 0 signifies low fraud threat and 1000 signifies excessive fraud threat.

So as to add the respective business-driven guidelines, full the next steps:

- On the Amazon Fraud Detector console, select Guidelines within the navigation pane.

- Select Add rule.

- Within the Outline a rule part, enter fraud for the rule title and, optionally, enter an outline.

- For Expression, enter the rule expression utilizing the Amazon Fraud Detector simplified rule expression language

$docdraud_insightscore >= 900 - For Outcomes, select Create a brand new consequence (An consequence is the consequence from a fraud prediction and is returned if the rule matches throughout an analysis.)

- Within the Create a brand new consequence part, enter decline as the end result title and an optionally available description.

- Select Save consequence

- Select Add rule to run the rule validation checker and save the rule.

- After it’s created, Amazon Fraud Detector makes the next

high_riskrule accessible to be used in your detector.- Rule title:

fraud - Final result:

decline - Expression:

$docdraud_insightscore >= 900

- Rule title:

- Select Add one other rule, after which select the Create rule tab so as to add further 2 guidelines as beneath:

- Create a

low_riskrule with the next particulars:- Rule title:

legit - Final result:

approve - Expression:

$docdraud_insightscore <= 500

- Rule title:

- Create a

medium_riskrule with the next particulars:- Rule title:

assessment wanted - Final result:

assessment - Expression:

$docdraud_insightscore <= 900 and docdraud_insightscore >=500

- Rule title:

These values are examples used for this submit. Once you create guidelines to your personal detector, use values which might be applicable to your mannequin and use case.

- After you may have created all three guidelines, select Subsequent.

Deploy the API to make predictions

After the rules-based actions have been triggered, you’ll be able to deploy an Amazon Fraud Detector API to guage the lending purposes and predict potential fraud. The predictions may be carried out in a batch or actual time.

Combine your SageMaker mannequin (Non-obligatory)

If you have already got a fraud detection mannequin in SageMaker, you’ll be able to combine it with Amazon Fraud Detector to your most popular outcomes.

This means that you should use each SageMaker and Amazon Fraud Detector fashions in your utility to detect several types of fraud. For instance, your utility can use the Amazon Fraud Detector mannequin to evaluate the fraud threat of buyer accounts, and concurrently use your PageMaker mannequin to test for account compromise threat.

Clear up

To keep away from incurring any future expenses, delete the sources created for the answer, together with the next:

- S3 bucket

- Amazon Fraud Detector endpoint

Conclusion

This submit walked you thru an automatic and customised answer to detect fraud within the mortgage underwriting course of. This answer means that you can detect fraudulent makes an attempt nearer to the time of fraud incidence and helps underwriters with an efficient decision-making course of. Moreover, the flexibleness of the implementation means that you can outline business-driven guidelines to categorise and seize the fraudulent makes an attempt personalized to particular enterprise wants.

For extra details about constructing an end-to-end mortgage doc fraud detection answer, consult with Part 1 and Part 2 on this collection.

In regards to the authors

Anup Ravindranath is a Senior Options Architect at Amazon Internet Companies (AWS) based mostly in Toronto, Canada working with Monetary Companies organizations. He helps prospects to remodel their companies and innovate on cloud.

Anup Ravindranath is a Senior Options Architect at Amazon Internet Companies (AWS) based mostly in Toronto, Canada working with Monetary Companies organizations. He helps prospects to remodel their companies and innovate on cloud.

Vinnie Saini is a Senior Options Architect at Amazon Internet Companies (AWS) based mostly in Toronto, Canada. She has been serving to Monetary Companies prospects remodel on cloud, with AI and ML pushed options laid on sturdy foundational pillars of Architectural Excellence.

Vinnie Saini is a Senior Options Architect at Amazon Internet Companies (AWS) based mostly in Toronto, Canada. She has been serving to Monetary Companies prospects remodel on cloud, with AI and ML pushed options laid on sturdy foundational pillars of Architectural Excellence.