Why and When to Use the Generalized Methodology of Moments | by Luis Felipe de Souza Rodrigues | Could, 2024

Hansen (1982) pioneered the introduction of the generalized methodology of moments (GMM), making notable contributions to empirical analysis in finance, notably in asset pricing. The creation of the mannequin was motivated by the necessity to estimate parameters in financial fashions whereas adhering to the theoretical constraints implicit within the mannequin. For instance, if the financial mannequin states that two issues ought to be impartial, the GMM will attempt to discover a answer by which the common of their product is zero. Subsequently, understanding GMM is usually a highly effective various for many who want a mannequin by which theoretical circumstances are extraordinarily essential, however which standard fashions can’t fulfill because of the nature of the information.

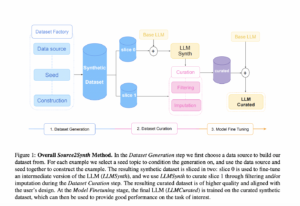

This estimation method is broadly utilized in econometrics and statistics to deal with endogeneity and different points in regression evaluation. The essential idea of the GMM estimator entails minimizing a criterion operate by selecting parameters that make the pattern moments of the information as shut as potential to the inhabitants moments. The equation for the Primary GMM Estimator will be expressed as follows:

The GMM estimator goals to search out the parameter vector θ that minimizes this criterion operate, thereby making certain that the pattern moments of the information align as intently as potential with the inhabitants moments. By optimizing this criterion operate, the GMM estimator gives constant estimates of the parameters in econometric fashions.

Being constant implies that because the pattern measurement approaches infinity, the estimator converges in chance to the true parameter worth (asymptotically regular). This property is essential for making certain that the estimator gives dependable estimates as the quantity of information will increase. Even within the presence of omitted variables, so long as the second circumstances are legitimate and devices are appropriately specified, GMM can present constant estimators. Nevertheless, the omission of related variables can influence the effectivity and interpretation of the estimated parameters.

To be environment friendly, GMM makes use of Generalized Least Squares (GLS) on Z-moments to enhance the precision and effectivity of parameter estimates in econometric fashions. GLS addresses heteroscedasticity and autocorrelation by weighting observations primarily based on their variance. In GMM, Z-moments are projected into the column house of instrumental variables, just like a GLS method. This minimizes variance and enhances parameter estimate precision by specializing in Z-moments and making use of GLS strategies.

Nevertheless, you will need to acknowledge that the GMM estimator is topic to a collection of assumptions that should be thought of throughout its utility, which have been listed:

- Existence of Moments: As much as a sure order is critical and requires finite tails within the distribution of the information.

- Appropriate Mannequin Specification: The underlying mannequin should be appropriately specified, together with the practical relationship and the distribution of error phrases.

- Identifiability: There should be a novel answer for the parameters to be estimated.

- Second Circumstances: It’s essential to specify the second circumstances appropriately, which will need to have zero imply beneath the mannequin assumptions.

- Legitimate Devices: If relevant, devices should be related and legitimate.

- Independence and Homoscedasticity (conditional): Ideally, errors ought to be impartial and homoscedastic beneath the second circumstances.

- Robustness to Heteroscedasticity: GMM is powerful to heteroscedasticity if the weighting matrix is constantly estimated.

- Multicollinearity: GMM can deal with multicollinearity, however it may have an effect on the effectivity of the estimators.

- Outliers: GMM is delicate to outliers until they’re correctly addressed within the modeling course of.

- Massive Samples: GMM is extra environment friendly in massive samples.

- Asymptotic Concept: Properties similar to consistency and effectivity are asymptotic.

Subsequently, GMM is a extremely versatile estimation method and will be utilized in a wide range of conditions, being broadly used as a parameter estimation method in econometrics and statistics. It permits for environment friendly estimation of parameters beneath completely different mannequin specs and knowledge constructions. Its primary makes use of are:

- Fashions with Instrumental Variables: used when there are endogenous variables in a mannequin. It gives a approach to appropriate bias in parameter estimation when explanatory variables are correlated with the error.

- Fashions with Measurement Errors: GMM can be utilized to appropriate bias launched by measurement errors in variables.

- Fashions with Second Restrictions: In some conditions, there are a number of second circumstances {that a} mannequin should fulfill. GMM lets you use all this info concurrently for extra environment friendly estimation.

- Time Sequence Fashions: GMM is commonly utilized in ARMA (AutoRegressive Transferring Common) fashions and different time collection fashions.

- Panel Information Fashions: It may be utilized in panel knowledge fashions to deal with points like heteroscedasticity and autocorrelation inside cross-sectional models.

- Nonlinear Fashions: GMM can be extendable to nonlinear fashions, offering a sturdy estimation method when classical strategies like Most Chance could also be infeasible.

The distinction between the Strange Least Squares (OLS) methodology and the Generalized Methodology of Moments (GMM) factors out completely different benefits. OLS proves itself environment friendly beneath the classical assumptions of linearity, serving as an unbiased linear estimator of minimal variance (BLUE). The elemental assumptions of a linear regression mannequin embrace: linearity within the relationship between variables, absence of excellent multicollinearity, zero imply error, homoscedasticity (fixed variance of errors), non-autocorrelation of errors and normality of errors. Subsequently, OLS is an unbiased, constant and environment friendly estimator. Moreover, it have comparatively decrease computational complexity.

Nevertheless, GMM gives extra flexibility, which is relevant to a variety of contexts similar to fashions with measurement errors, endogenous variables, heteroscedasticity, and autocorrelation. It makes no assumptions concerning the distribution of errors and is relevant to nonlinear fashions. GMM stands out in circumstances the place we’ve got omitted essential variables, a number of second circumstances, nonlinear fashions, and datasets with heteroscedasticity and autocorrelation.

Conversely, when evaluating GMM and Most Chance Estimation (MLE), it highlights their approaches to dealing with knowledge assumptions. GMM constructs estimators utilizing knowledge and inhabitants second circumstances, offering flexibility and adaptableness to fashions with fewer assumptions, notably advantageous when robust assumptions about knowledge distribution might not maintain.

MLE estimates parameters by maximizing the chance of the given knowledge, relying on particular assumptions about knowledge distribution. Whereas MLE performs optimally when the assumed distribution intently aligns with the true data-generating course of, GMM accommodates numerous distributions, proving precious in situations the place knowledge might not conform to a single particular distribution.

Within the hypothetical instance demonstrated in Python, we make the most of the linearmodels.iv library to estimate a GMM mannequin with the IVGMM operate. On this mannequin, consumption serves because the dependent variable, whereas age and gender (represented as a dummy variable for male) are thought of exogenous variables. Moreover, we assume that earnings is an endogenous variable, whereas the variety of kids and schooling degree are instrumental variables.

import pandas as pd

from linearmodels.iv import IVGMM# Learn the Excel file

df = pd.read_excel('instance.xlsx')

# Dependent variable

dependent = 'YConsumption'

# Exogenous variables

exog_vars = ['XAge', 'XMale1']

# Endogenous variable

endog_vars = ['XIncomeEndo']

# Instrumental variables

devices = ['ZChildQuantity6', 'ZEducation']

# Assemble the formulation for GMM

formulation = "{dep} ~ 1 + {exog} + [{endog} ~ {instr}]".format(

dep=dependent,

exog='+'.be a part of(exog_vars),

endog=endog_vars[0],

instr='+'.be a part of(devices)

)

# Estimate the GMM mannequin

mannequin = IVGMM.from_formula(formulation, df)

end result = mannequin.match(cov_type='strong')

# Displaying GMM outcomes

print(end result)

Instrumental variables in GMM fashions are used to deal with endogeneity points by offering a supply of exogenous variation that’s correlated with the endogenous regressors however uncorrelated with the error time period. The IVGMM operate is particularly designed for estimating fashions by which instrumental variables are used throughout the framework of GMM.

Subsequently, by specifying Consumption because the dependent variable and using exogenous variables (age and gender) together with instrumental variables (variety of kids and schooling) to deal with endogeneity, this instance matches throughout the GMM context.