AI vs. Human Perception in Monetary Evaluation | by Misho Dungarov | Mar, 2024

Can the very best AI fashions right now, precisely choose up a very powerful message out of an organization earnings name? They will actually choose up SOME factors however how do we all know if these are the essential ones? Can we immediate them into to doing a greater job? To seek out these solutions, we take a look at what the very best journalists within the discipline have carried out and attempt to get as near that with AI

On this article, I take a look at 8 latest firm earnings calls and ask the present contestants for smartest AIs (Claude 3, GPT-4 and Mistral Large) what they suppose is essential. Then examine the outcomes to what among the greatest names in Journalism (Reuters, Bloomberg, and Barron’s) have mentioned about these actual studies.

The Significance of Earnings Calls

Earnings calls are quarterly occasions the place senior administration opinions the corporate’s monetary outcomes. They talk about the corporate’s efficiency, share commentary, and typically preview future plans. These discussions can considerably impression the corporate’s inventory worth. Administration explains their future expectations and causes for assembly or surpassing previous forecasts. The administration crew affords invaluable insights into the corporate’s precise situation and future route.

The Energy of Automation in Earnings Evaluation

Statista studies that there are just below 4000 companies listed on the NASDAQ and about 58,000 globally in response to one estimate.

A typical convention name lasts roughly 1 hour. To simply take heed to all NASDAQ corporations, one would want not less than 10 folks working full-time for the complete quarter. And this doesn’t even embody the extra time-consuming duties like analyzing and evaluating monetary studies.

Massive brokerages may handle this workload, nevertheless it’s unrealistic for particular person traders. Automation on this space might degree the enjoying discipline, making it simpler for everybody to grasp quarterly earnings.

Whereas this may increasingly simply be inside attain of huge brokerages, it’s not possible for personal traders. Subsequently, any dependable automation on this house will probably be a boon, particularly for democratizing the understanding of quarterly earnings.

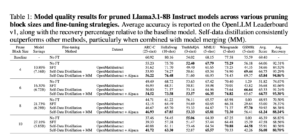

To check how effectively the very best LLMs of the day can do that job. I made a decision to check the primary takeaways by people and see how effectively AI can mimic that. Listed below are the steps:

- Decide some corporations with latest earnings name transcripts and matching information articles.

- Present the LLMs with the complete transcript as context and ask them to supply the highest three bullet factors that appear most impactful for the worth of the corporate. That is essential as, offering an extended abstract turns into progressively simpler — there are solely so many essential issues to say.

- To make sure we maximise the standard of the output, I range the way in which I phrase the issue to the AI (utilizing completely different prompts): Starting from merely asking for a abstract, including extra detailed directions, including earlier transcripts and a few mixtures of these.

- Lastly, examine these with the three most essential factors from the respective information article and use the overlap as a measure of success.

GPT-4 exhibits greatest efficiency at 80% when offering it the earlier quarter’s transcript and utilizing a set of directions on methods to analyse transcripts effectively (Chain of Thought). Notably, simply utilizing appropriate directions will increase GPT-4 efficiency from 51% to 75%.

- Subsequent greatest performers are:

— Claude 3 Opus (67%) — With out refined prompting, Claude 3 Opus works greatest.

— Mistral Massive (66%) when including supporting directions (i.e. Chain of Thought) - Chain-of-thought (CoT) and Suppose Step by Step (SxS) appear to work effectively for GPT-4 however are detrimental for different fashions. This implies there may be nonetheless so much to be discovered about what prompts work for every LLM.

- Chain-of-Thought (CoT) appears virtually all the time outperforms Step-by-step (SxS). This implies tailor-made monetary information of priorities for evaluation helps. The precise directions supplied are listed on the backside of the article.

- Extra data-less sense: Including a earlier interval transcript to the mannequin context appears to be not less than barely and at worst considerably detrimental to outcomes throughout the board than simply specializing in the most recent outcomes (apart from GPT-4 + CoT). Probably, there may be a lot irrelevant data launched from a earlier transcript and a comparatively small quantity of particular details to make a quarter-on-quarter comparability. Mistral Massive’s efficiency drops considerably, be aware that its context window is simply 32k tokens vs the considerably bigger ones for the others (2 transcripts + immediate truly simply barely match underneath 32k tokens).

- Claude-3 Opus and Sonnet carry out very carefully, with Sonnet truly outperforming Opus in some instances. Nevertheless, this tends to be by a couple of %-age factors and might subsequently be attributed to the randomness of outcomes.

- Notice that, as talked about, outcomes present a excessive diploma of variability and the vary of outcomes is inside +/-6%. For that motive, I’ve rerun all evaluation 3 occasions and am exhibiting the averages. Nevertheless, the +/-6% vary shouldn’t be ample to considerably upend any of the above conclusions

How the Bud Gentle Boycott and Salesforce’s AI plans confused the very best AIs

This job affords some straightforward wins: guessing that outcomes are in regards to the newest income numbers and subsequent 12 months’s projections is pretty on the nostril. Unsurprisingly, that is the place fashions get issues proper more often than not.

The desk beneath provides an summary of what was talked about within the information and what LLMs selected in a different way when summarized in just some phrases.

Subsequent, I attempted to search for any tendencies of what the fashions constantly miss. These usually Fall into a couple of classes:

- Making sense of adjustments: Within the above outcomes, LLMs have been in a position to perceive pretty reliably what to search for: earnings, gross sales, dividend, and steerage, nonetheless, making sense of what’s vital continues to be very elusive. As an illustration, commonsense may recommend that This autumn 2023 outcomes will probably be a key matter for any firm and that is what the LLMs choose. Nevertheless, Nordstrom talks about muted income and demand expectations for 2024 which pushes This autumn 2023 outcomes apart when it comes to significance

- Hallucinations: as is effectively documented, LLMs are inclined to make up details. On this case, regardless of having directions to “solely embody details and metrics from the context” some metrics and dates find yourself being made up. The fashions sadly won’t be shy about speaking in regards to the This autumn 2024 earnings by referring to them as already out there and utilizing the 2023 numbers for them.

- Vital one-off occasions: Sudden one-off occasions are surprisingly typically missed by LLMs. As an illustration, the boycott of Bud Gentle drove gross sales of the best-selling beer within the US down by 15.9% for Anheuser-Busch and is mentioned at size within the transcripts. The quantity alone ought to seem vital, nonetheless it was missed by all fashions within the pattern.

- Actions converse louder than phrases: Each GPT and Claude spotlight innovation and the dedication to AI as essential.

— Salesforce (CRM) talks at size a few heavy give attention to AI and Knowledge Cloud

— Snowflake appointed their SVP of AI and former exec of Google Advertisements as CEO (Sridhar Ramaswamy), equally signaling a give attention to leveraging AI expertise.

Each sign a shift to innovation & AI. Nevertheless, journalists and analysts will not be as simply tricked into mistaking phrases for actions. Within the article analyzing CRM’s earnings, the subtitle reads Salesforce Outlook Disappoints as AI Fails to Spark Progress. Nevertheless, Salesforce has been making an attempt to tango with AI for some time and the forward-looking plans to make use of AI will not be even talked about. Salesforce’s transcript mentions AI 91 occasions whereas Snowflake’s lower than half of that at 39. Nevertheless, people could make the excellence in which means: Bloomberg’s article https://towardsdatascience.com/ai-vs-human-insight-in-financial-analysis-89d3408eb6d5?supply=rss—-7f60cf5620c9—4 on the appointment of a brand new CEO: His elevation underscores a give attention to AI for Snowflake.

- Why Earnings name transcripts? The extra intuitive selection could also be firm filings, nonetheless, I discover transcripts to current a extra pure and fewer formal dialogue of occasions. I imagine transcripts give the LLM as a reasoning engine a greater likelihood to glean extra pure commentary of occasions versus the dry and extremely regulated commentary of earnings. The calls are largely administration displays, which could skew issues towards a extra optimistic view. Nevertheless, my evaluation has proven the efficiency of the LLMs appears comparable between optimistic and unfavorable narratives.

- Selection of Corporations: I selected shares which have revealed This autumn 2023 earnings studies between 25 Feb and 5 March and have been reported on by certainly one of Reuters, Bloomberg, or Barron’s. This ensures that the outcomes are well timed and that the fashions haven’t been educated on that knowledge but. Plus, everybody all the time talks about AAPL and TSLA, so that is one thing completely different. Lastly, the repute of those journalistic homes ensures a significant comparability. The 8 shares we ended up with are: Autodesk (ADSK), BestBuy (BBY), Anheuser-Busch InBev (BUD), Salesforce (CRM), DocuSign (DOCU), Nordstrom (JWN), Kroger (KR), Snowflake (SNOW)

- Variability of outcomes LLM outcomes can range between runs so I’ve run all experiments 3 occasions and present a mean. All evaluation for all fashions was carried out utilizing temperature 0 which is often used to reduce variation of outcomes. On this case, I’ve noticed completely different runs have as a lot as 10% distinction in efficiency. That is because of the small pattern (solely 24 knowledge factors 8 shares by 3 statements) and the truth that we’re principally asking an LLM to decide on certainly one of many attainable statements for the abstract, so when this occurs with some randomness it will probably naturally result in choosing a few of them in a different way.

- Selection of Prompts: For every of the three LLMs compared check out 4 completely different prompting approaches:

- Naive — The immediate merely asks the mannequin to find out the most definitely impression on the share worth.

- Chain-of-Thought (CoT) — the place I present an in depth listing of steps to observe when selecting a abstract. That is impressed and loosely follows [Wei et. al. 2022] work outlining the Chain of Thought method, offering reasoning steps as a part of the immediate dramatically improves outcomes. These extra directions, within the context of this experiment, embody typical drivers of worth actions: adjustments to anticipated efficiency in income, prices, earnings, litigation, and many others.

- Step by Step (SxS) aka Zero-shot CoT, impressed by Kojima et.al (2022) the place they found that merely including the phrase “Let’s suppose step-by-step” improves efficiency. I ask the LLMs to suppose step-by-step and describe their logic earlier than answering.

- Earlier transcript — lastly, I run all three of the above prompts as soon as extra by together with the transcript from the earlier quarter (on this case Q3)

From what we are able to see above, Journalists’ and Analysis Analysts’ jobs appear secure for now, as most LLMs wrestle to get greater than two of three solutions appropriately. Normally, this simply means guessing that the assembly was in regards to the newest income and subsequent 12 months’s projections.

Nevertheless, regardless of all the restrictions of this take a look at, we are able to nonetheless see some clear conclusions:

- The accuracy degree is pretty low for many fashions. Even GPT-4’s greatest efficiency of 80% will probably be problematic at scale with out human supervision — giving flawed recommendation one in 5 occasions shouldn’t be convincing.

- GPT4 appears to nonetheless be a transparent chief in advanced duties it was not particularly educated for.

- There are vital positive factors when appropriately immediate engineering the duty

- Most fashions appear simply confused by additional data as including the earlier transcript usually reduces efficiency.

The place to from right here?

We’ve got all witnessed that LLM capabilities repeatedly enhance. Will this hole be closed and the way? We’ve got noticed three sorts of cognitive points which have impacted efficiency: hallucinations, understanding what’s essential and what isn’t (e.g. actually understanding what’s shocking for an organization), extra advanced firm causality points (e.g. just like the Bud Gentle boycott and the way essential the US gross sales are relative to an general enterprise):

- Hallucinations or eventualities the place the LLM can’t appropriately reproduce factual data are a serious stumbling block in functions that require strict adherence to factuality. Superior RAG approaches, mixed with analysis within the space proceed to make progress, [Huang et al 2023] give an summary of present progress

- Understanding what’s essential — fine-tuning LLM fashions for the precise use case ought to result in some enhancements. Nevertheless, these include a lot larger necessities on crew, value, knowledge, and infrastructure.

- Advanced Causality Hyperlinks — this one could also be route for AI Brokers. As an illustration, within the Bud Gentle boycott case, the mannequin may have to:

1. the significance of Bud Gentle to US gross sales, which is probably going peppered by way of many displays and administration commentary

2. The significance of US gross sales ot the general firm, which might be gleaned from firm financials

3. Lastly stack these impacts to all different impacts talked about

Such causal logic is extra akin to how a ReAct AI Agent may suppose as an alternative of only a standalone LLM [Yao, et al 2022]. Agent planning is a sizzling analysis matter [Chen, et al 2024]

Disclaimers

The views, opinions, and conclusions expressed on this article are my very own and don’t mirror the views or positions of any of the entities talked about or another entities.

No knowledge was used to mannequin coaching nor was systematically collected from the sources talked about, all strategies have been restricted to immediate engineering.